There is a class of stock funds marketed as being “less risky” than the general market. They are called low volatility or minimum vol. ETFs.

I will compare three popular low volatility ETFs funds to the S&P 500 index fund (SPY) to see if indeed they reduced the risk that investors have had to go through so far in 2020.

USMV – iShares Edge MSCI Min Vol USA ETF

SPLV – Invesco S&P 500® Low Volatility ETF

SPLV – Invesco S&P 500® Low Volatility ETF

VFMV – Vanguard U.S. Minimum Volatility ETF

VFMV – Vanguard U.S. Minimum Volatility ETF

When I think of a fund that provides “potentially less risk” than the broad S&P index, I imagine a fund that will experience a smaller loss (by several percentage points) than the overall market when the stock market is going through a rough patch.

This year, 2020, is certainly one of those rough patches.

How did these 3 low volatility ETFs compare with the SPY index fund?

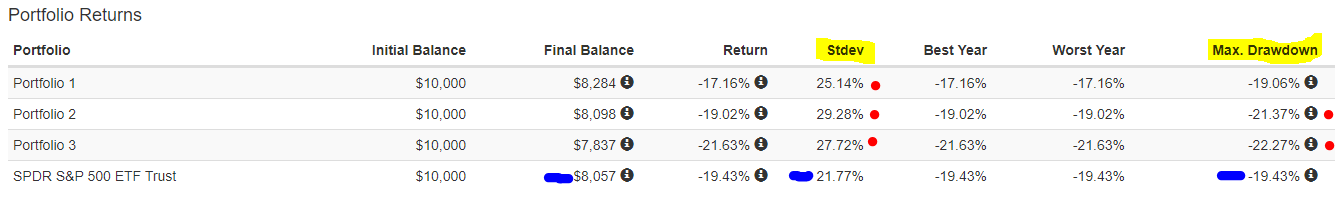

Portfolio 1 = USMV

Portfolio 2 = SPLV

Portfolio 3 = VFMV

The benchmark we are comparing everything to is on the bottom row of the chart – SPY ETF (blue marks).

I want to draw your attention to the far-right column. This Max. Drawdown column tells us the largest percentage lost during 2020 (using end of month values for each fund). In other words, the drawdown could have been larger at some point during one of the three months so far in 2020, but if you opened your statement at the end of each month, this number is the largest loss you would have seen.

I want to draw your attention to the far-right column. This Max. Drawdown column tells us the largest percentage lost during 2020 (using end of month values for each fund). In other words, the drawdown could have been larger at some point during one of the three months so far in 2020, but if you opened your statement at the end of each month, this number is the largest loss you would have seen.

Obviously, we want this number to be as small as possible. When I think of a low volatility investment, it should have a smaller max. drawdown than the standard ETF. At least that is how I would define low volatility.

That wasn’t the case for two of these min vol funds, and the other was only 0.37% better than the benchmark. In dollar terms that would be a $370 smaller drawdown for each $100,000 invested. That’s basically even.

Another column that shows these min. volatility funds are falsely named and not worth buying is the “StDev” (annualized standard deviation of monthly returns) column. Standard deviation is a measure of how much the returns move up and down from their average return.

Another column that shows these min. volatility funds are falsely named and not worth buying is the “StDev” (annualized standard deviation of monthly returns) column. Standard deviation is a measure of how much the returns move up and down from their average return.

For each low vol fund, the standard deviation is higher than the benchmark S&P 500!

Low vol ETFs with high standard deviations? That is a total fail by these funds.

The lesson here is that when you consider buying an investment fund, you need to understand what the fund actually holds and how its strategy is designed to make money. The fund’s name can be misleading.

These “low volatility” funds are just a collection of stocks that have moved up and down less than the others in the index over the last 12 months. There are no safeguards or uncorrelated assets that would limit the volatility. There is nothing these funds are doing that provides protection against down markets.

As we have seen in 2008 and 2020, when there is a shock to the market, all stocks go down. Regardless of whether or not they are named “low volatility”.

Ready to discuss your portfolio? Click here to schedule a time to talk.