I want to show you how to replicate the Vanguard Personal Advisor Services investments with another Vanguard offering, possibly saving you thousands of dollars per year.

There is a certain allure to the Personal Advisor Services because Vanguard will invest your money in Vanguard funds and take care of the hassle of maintaining your portfolio at your recommended asset allocation. When you sign up for the service, you will take a risk tolerance questionnaire, and Vanguard will determine the correct allocation for you after taking your goals into consideration. After signing up, there is no work left for you to do, Vanguard will take care of the ongoing investment management.

Before you rush off to sign up, let’s take a look at some of the fine print in the Vanguard personal advisor services brochure.

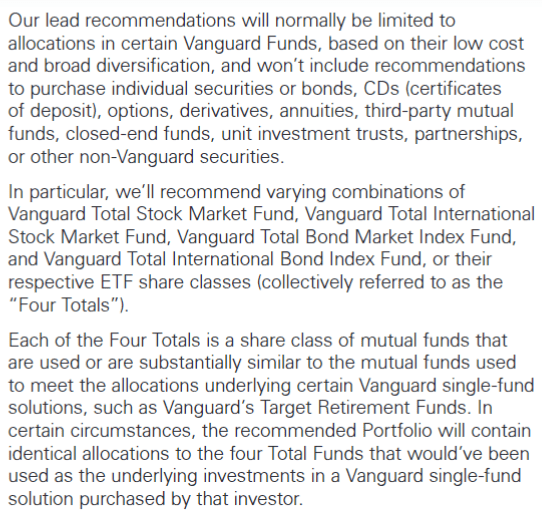

Paragraph 1: “Our lead recommendations will normally be limited to allocations in certain Vanguard funds.” That’s obvious. Of course they will put your money in Vanguard funds, so no surprise there.

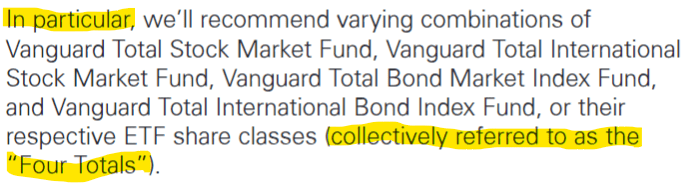

Paragraph 2: the details of which Vanguard mutual funds will be used by the Personal Advisor Services are laid out right in front of you.

So, your Personal Advisor Services allocation may / will be composed of 4 funds: The Vanguard Total Stock Market Fund, Vanguard Total International Stock Market Fund, Vanguard Total Bond Market Index Fund, and Vanguard Total International Bond Index Funds. This is especially true if you are investing cash with the Vanguard advisor services, as opposed to turning over a portfolio of funds you already own.

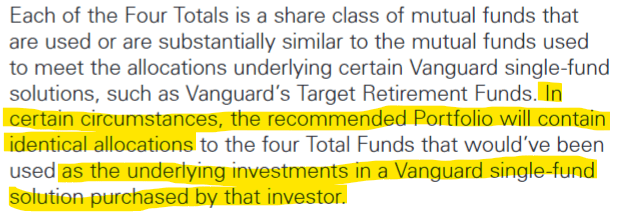

Paragraph 3: they lay out exactly how you could copy the service.

They state, “each of the four totals …are substantially similar to the mutual funds used to meet the allocations underlying certain Vanguard single fund solutions”. In other words, there are mutual funds at Vanguard that are comprised of these four funds.

As we continue reading this third paragraph of fine print here’s the real kicker: “In certain circumstances, the recommended portfolio will contain identical allocations to the Four Total funds that would have been used as the underlying investments in a Vanguard single-fund solution”. Oh my.

Vanguard just told us that their Personal Advisor Services will be or may be an exact replica of a single fund that is already available at Vanguard.

I found these single funds that replicate the Personal Advisor Services. They are named Vanguard LifeStrategy funds.

Vanguard LifeStrategy funds

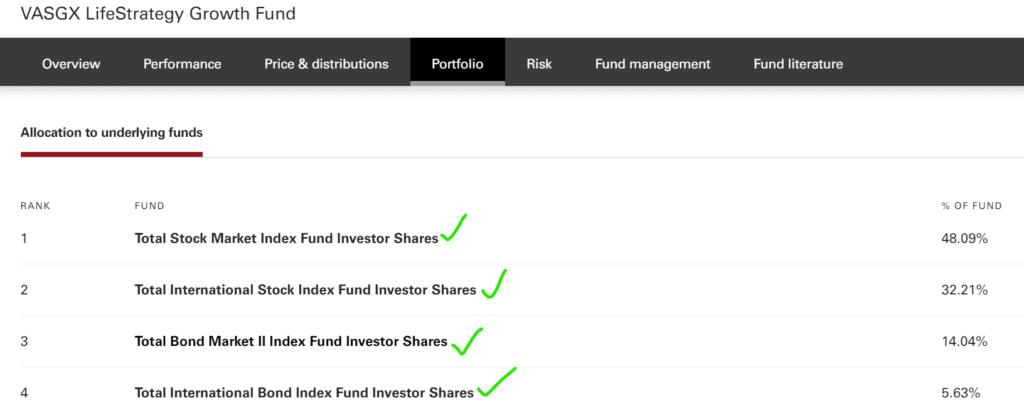

There are four LifeStrategy mutual funds which are comprised of various combinations of the big Four Total funds (Vanguard Total Stock Market Fund, Vanguard Total International Stock Market Fund, Vanguard Total Bond Market Index Fund, and Vanguard Total International Bond Index Funds). The LifeStrategy funds come in various target allocations.

- Income fund (VASIX) – allocation of 20% stocks & 80% bonds.

- Conservative growth fund (VSCGX) – 40% stocks & 60% bonds.

- Moderate growth fund (VSMGX) – 60% stocks & 40% bonds.

- Growth fund (VASGX) – 80% stocks and 20% bonds.

The characteristic that makes these funds a replacement for the Vanguard Personal Advisor Services is the fact that they automatically rebalance the four holdings within them to keep the allocation at the desired level. The ongoing management is done for you, by the fund, not by a manager for an additional fee.

Handing off the hassle of rebalancing their investments is a major reason why people (especially retirees) sign up for the Personal Advisor Services. Instead, they could buy a LifeStrategy fund.

Cost Savings

The Vanguard Personal Advisor Service charges 0.30% of the amount you have invested each and every year. That means for a $500,000 investment, you will pay Vanguard $1,500 to manage your investment for you. That is in addition to the fund fees which range from (0.04% to 0.11% annually).

If you open a Vanguard account and buy a LifeStrategy fund, you will pay only the LifeStrategy fund fees (0.11% to 0.14% annually).

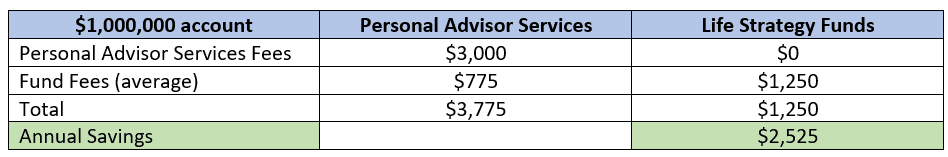

Let’s compare the fees a retiree with a $1,000,000 account will pay each year.

Using the LifeStrategy funds will save you more than $200 per month.

An additional option is to use this savings to get annual financial planning improvements from an independent financial planner like Andrew Marshall Financial, LLC. We give clients objective advice that considers all aspects of their life, not just the accounts invested at one company. We can help you set up your Vanguard accounts to use LifeStrategy funds and much more. Click here to set up a free video call.