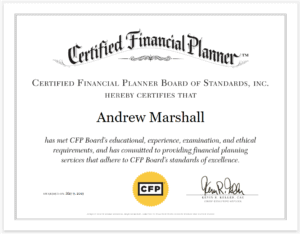

Are you a CERTIFIED FINANCIAL PLANNER™?

Are you a CERTIFIED FINANCIAL PLANNER™?

Yes. The CERTIFIED FINANCIAL PLANNER™ mark, or CFP® certification, is the gold standard in financial planning because it requires a lot of hard work and dedication to achieve. Becoming a CFP® requires taking college coursework (I completed this at UC Irvine), passing a board exam (I passed the exam in 2015), and completing 6,000 hours of work experience.

Are you a fiduciary?

Yes. Andrew Marshall Financial, LLC is a registered investment advisor with the State of California. As a registered investment advisor, we are a fiduciary and required by law to provide advice that is in your best interest. You come first.

How are you compensated?

Solely by our clients. AMF is a fee only financial advisory firm. That means we don’t take commissions or kickbacks.

What are your clients like? Who do you usually work with?

Our new clients are over 50 years old; most are around 60. Their kids have grown, they are in the high-earning years of their lives, and they are starting to wonder when they will be able to retire. Many have been managing their finances on their own and have never worked with a financial advisor before. They are not a good fit for traditional financial advisory firms that manage investments because their money is in their 401(k)/403(b), they will receive a pension, or they are comfortable managing their own investment accounts. They want a retirement plan that covers topics such as:

-

- will they have enough money to retire,

- claiming Social Security,

- adjusting their investments for safety,

- paying off their mortgage early,

- reducing taxes in retirement,

- withdrawing from their investments,

- Medicare,

- and many others.

Am I required to move my investment accounts to work with you?

No. You will keep your investment accounts where they are now. We do not manage investments at Andrew Marshall Financial, LLC.

If you do not manage my investments, how can you help me?

I will review your current investments and make recommendations on any adjustments I think are needed, regardless of where the accounts are held. This includes reviewing your 401(k) allocation and the fund choices available to you. You will take the recommendations, login to your accounts, and make the changes yourself.

Generally, our clients fit into one of the following three investing situations, or a combination of the three. These days there are services available that manage investments for very reasonable fees. Depending on your situation and needs, I can recommend a service that is a good fit for you.

- You invest through a company 401(k), 403(b), TSP or other retirement savings plan. The company has a list of funds to choose from. I will review your selections and advise on their appropriateness for your goals and time frame. No third-party investment manager is needed.

- You have investment accounts outside of a work plan. You are not interested in or don’t have the time to manage your own investments. I will recommend and help you establish new accounts or transfer old accounts to a low-cost, third-party manager with excellent portfolio options that fits your needs.

- You are comfortable managing your own investments and have a brokerage account at TD Ameritrade, Charles Schwab, Fidelity, Vanguard, etc. I will review your holdings and give recommendations on the appropriateness and robustness of your investment plan. You will then implement these recommendations on your own.

Can I work with you even if I don’t live near Carlsbad, California?

Yes, distance is not a problem. We can work together via phone calls, emails, or video conferencing software. I have helped clients across the US and even in foreign countries.

How do I get started and what is the process for working with you?

- Step one is to schedule your first, free meeting. You have the option of doing this meeting in-person or via video or phone call.

- Before our first meeting, you will fill in a brief questionnaire.

- At our first meeting, we will discuss your concerns, how I can help, and decide what elements to include in your financial planning project.

- The next day I will write a detailed proposal that includes a price quote.

- If you agree to the proposal and quote, we sign a contract and you send a $360 deposit.

- You then gather and upload or send me the documents and data I need to create your financial plan.

- We have emails or phone calls back and forth to clarify things or if I need additional information as I develop your plan.

- If appropriate, we have an interim meeting to discuss your options on various topics.

- After further work on my part, we meet again to go over the final plan.

- If you have any questions about the financial planning process I use, call (760) 651-6315. Or email contactus@andrewmarshallfinancial.com

What documents do I need to gather?

The exact list will depend on your situation, but some commonly needed data points include the following. I do not ask for these until after we have signed a contract.

- Income amounts – gross and take home

- Amount you save each month outside of 401(k)/403(b)s

- Mortgage, auto loan, credit card and student loan details

- Amounts in your checking and savings accounts

- Percentage or amount you contribute to your 401(k)/403(b)

- Possible funds you could invest in, in your 401(k)/403(b)

- Insurance policy declaration pages

- Social Security statement

- Investment statements

- Tax return

- Pay stub

Why did you become a financial planner?

Financial planning is the best way to combine my loves of helping people, researching topics that interest me, and solving puzzles. Researching topics and methods to improve your finances and combining them in a way that works for you is something I really enjoy. It’s a great challenge to combine the numbers with the personality. It is also exciting because each project is different. There are no two clients who are alike.

What did you do before you were a financial planner?

I had a previous career working as a laboratory scientist at a couple of small biotech companies in San Diego. At one company I was responsible for developing a new technology to create DNA, and at the other, I was responsible for making viruses (like the flu) which were sold to diagnostic companies or researchers developing treatments. I also worked as the quality assurance lead at the virus company, making sure that everything we made was precise and correct.

How has being a scientist carried over into financial planning?

Changing careers from science to financial planning means a different subject matter, but it is similar in a lot of ways. Financial planning still entails analyzing lots of data, researching background details, drawing the correct conclusions, and determining what the next steps should be. And of course, both require working with numbers.

What is the Garrett Planning Network? Why are you a member?

The Garrett Planning Network is a nationwide network of financial planners who work with a historically ignored part of the population – those people who do not have large investment accounts for a financial advisor to manage. Garrett Planning Network members do not target high net worth clients. Instead, we work with middle class employees and retirees who also deserve to get good financial advice.

The Garrett Planning Network provides me with lots of continuing education, a large group of colleagues who act as mentors, and an annual retreat in Colorado where I go each year to improve my financial planning knowledge and skills.

Do you provide a written agreement detailing the services you will provide and the cost, before beginning the engagement?

Yes we do. We both sign a contract before any charges are accrued. Our process begins with you contacting us and telling us what you need. You complete a confidential questionnaire and we schedule a free, no obligation meeting to get acquainted with each other. We meet and discuss your needs, desires and value that a financial plan will bring to your life. During the next business day, I provide a detailed proposal. If you like the proposal and want to proceed, we sign a contract and get started on your financial plan.

Do you have minimums for assets, account sizes, income, annual fees paid, etc.?

No, there are no minimums of any kind to work with me. I want to be able to help you regardless of how much financial success you have had previously. My pricing page is here.

What will my financial plan look like? What will I receive?

Your financial plan will be a typed report, written by me, covering the topics we agreed on in the contract. The report covers the calculations and reasoning behind my recommendations. It will include an action list of tasks you need to do to put the plan in place. Click here to see a sample financial plan blog post.

Do you offer assistance with implementation of the plan?

Yes. If you would like assistance placing trades, filling out forms, or making sure everything is implemented properly, we can include that in your project contract.

If appropriate, I can refer you to attorneys and tax preparers.

After the initial plan, how do we work together?

Future updates are on your schedule. I generally recommend annual reviews in the years leading up to and just after retirement, but if you prefer every 6-months, 18-months, 2 years, etc., it is up to you. You will contact me as needed, and we will agree on a proposal for the work you need done at that time.

Will you provide a second opinion or one-time review?

Yes. I can review your self-created plan or a plan or idea that another advisor has come up with.

Are you a broker?

No, I am not. A broker sells stocks and other investments for commissions. I do not sell stocks or investments, and I do not receive commissions.

Are you an insurance agent?

No, I am not. Insurance agents sell insurance or annuities for commissions. I do not sell insurance or annuities, and I do not receive commissions.

To get started now: Complete our Questionnaire and Schedule your Free, First Meeting