Christine Benz is very well known in retirement planning circles due to her work at Morningstar where she does retirement research on portfolio planning topics. She gave a talk to the American Association of Individual Investors (AAII) San Diego group in November 2019.

Christine Benz is very well known in retirement planning circles due to her work at Morningstar where she does retirement research on portfolio planning topics. She gave a talk to the American Association of Individual Investors (AAII) San Diego group in November 2019.

Since I have read many of Christine Benz’s articles on the Morningstar.com website, and the topic of her talk was obviously relevant to my work, I thought it would be good to go and see her in person.

The AAII group meets in Solana Beach once a month and when they have interesting speakers, I try to go. The meeting is open to anyone and is only $8.

Retirement Date Risk

The first risk Christine Benz talked about was retirement date risk. Often someone must retire at a point in time other than when they plan to retire or expect to retire. This early or late retirement date could be a result of health issues, family issues, job layoffs, or other reasons.

This is retirement date risk.

Forced retirement is a problem because it decreases the time for saving. If you have a financial plan, you know you need to save X amount per year for so many more years and your safe retirement spending will be Y. If your ability to save is cut short, then your retirement spending will have to be cut as well.

For many people who are laid off late in their career, finding a new job that pays as well as the one they left is very difficult to do.

Another major cause of retirement date risk is health issues. Either your own, or a spouse’s health issues, or someone else in your family like your parents. This can force you to reduce your work load and therefore your savings rate.

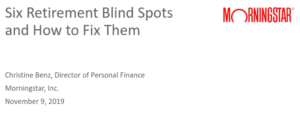

This graph from Ms. Benz’ presentation shows that more often people retired earlier than they were expecting, rather than have to work longer than they were expecting. 25% of pre-retirees were expecting to retire at 64 or younger (blue bars), but 70% of retirees actually retired before 65 (green bars).

Early retirement is very common and therefore you need to be ready in case that happens.

The way to overcome retirement date risk is to save more than you think you should. Rather than planning for a perfect scenario to play out at age 65, plan for having enough money by 60 or 62. Try and save more money so that a forced retirement date does not require you to live the remainder of your life with a reduced spending ability.

Sequence of Return Risk

When you first retire, you are at your most susceptible point in terms of stock market returns.

If the stock market goes down immediately after you retire, your likelihood of retirement success also goes down.

The worst point in time to retire since World War II was 1969. The safe withdrawal rate for a new retiree in 1969 was 4% per year adjusted for inflation. As a comparison, those who retired in 1981 were able to withdraw 8.5% per year adjusted for inflation without running out of money after 30 years. That is a huge difference! That’s the sequence of returns risk.

How does one overcome the sequence of returns risk? By not selling stocks to cover living expenses.

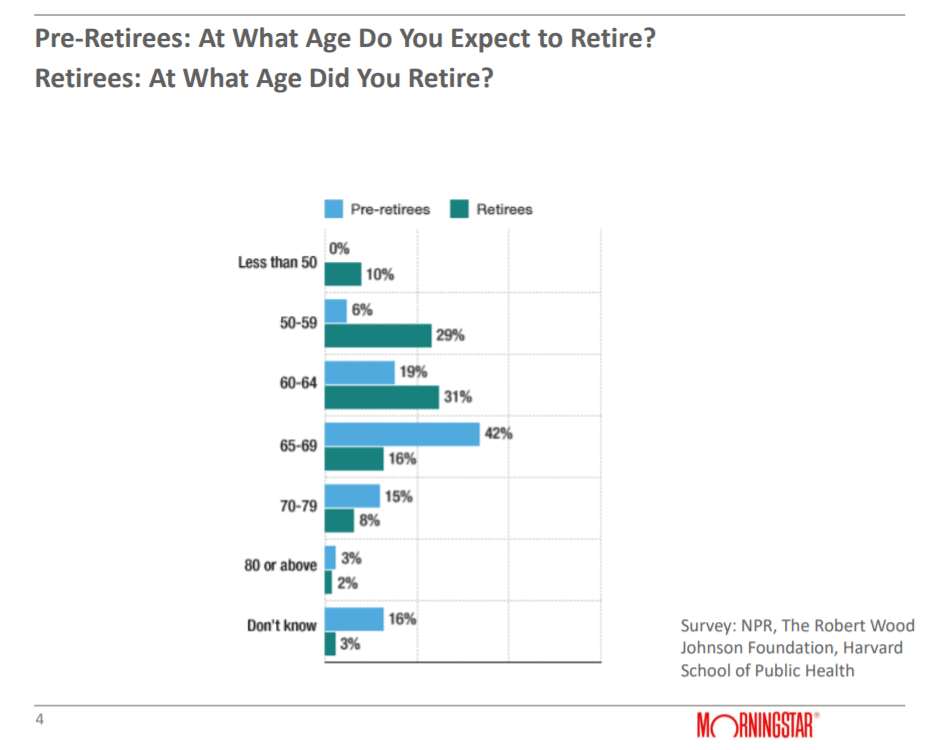

Christine Benz recommends the bucket portfolio.

With the bucket portfolio approach you keep a few years of living expenses in cash, the next few years of living expenses in bonds, and the remainder in stocks. The idea is that as you spend the cash, each year you replenish your cash from your bonds and then you replenish your bonds from your stocks when the market stock market is in an up year.

Another take on this idea of retirement withdrawal strategy (that I’ve written about before), is by Michael McClung and described in his book Living Off Your Money. Essentially his idea is that you sell bonds when you need money and then only replenish those bonds when the market has gone up 20% inflation adjusted.

The benefit of both these strategies is the fact that you’re not forced to sell stocks when they are at their lowest point.

Low-Yield Risk

Another risk for retirees who would like to live off the interest from safe investments is the low yield world we now live in.

I went to a fixed income conference in San Diego in November a couple weeks ago and the keynote speaker, James Bianco, believes we will be in a low rate environment for many years to come.

What this means for retirees is you can’t just buy CD’s and live off the interest generated. Retirees are forced to own a higher percentage of stocks than they were in previous decades.

The way to overcome this low yield risk is to invest not for income, but to invest for total return.

This means that you should consider not just the interest an investment earns, but also the change in underlying value. Bonds not only pay interest, but they go up and down in value each day the bond market is open.

It is unlikely a retiree will be able to live off the mid 2% interest an aggregate bond fund generates these days (unless they have a lot saved or need little). To withdraw 4% from their accounts, retirees should consider the 2% interest payments along with both the change in value of the bonds and the change in value of the stocks they own. The portfolio should be thought of as a whole, as total return.

The incorrect way to overcome this low yield risk according to Ms. Benz is to invest in risky bonds. Retirees should not reach for yield by putting their life savings in high yield bonds or emerging market bonds. The risk it’s just too high and the yield that you get is still minimal. It is better to use a comprehensive bucket portfolio type approach to create enough money to live off.

Inflation Risk

With 3% inflation everything costs double after 24 years. That’s inflation risk.

By the time you are 20 years into your retirement, things are going to cost a lot more than they do now. We have all seen prices go up and know it will continue to happen.

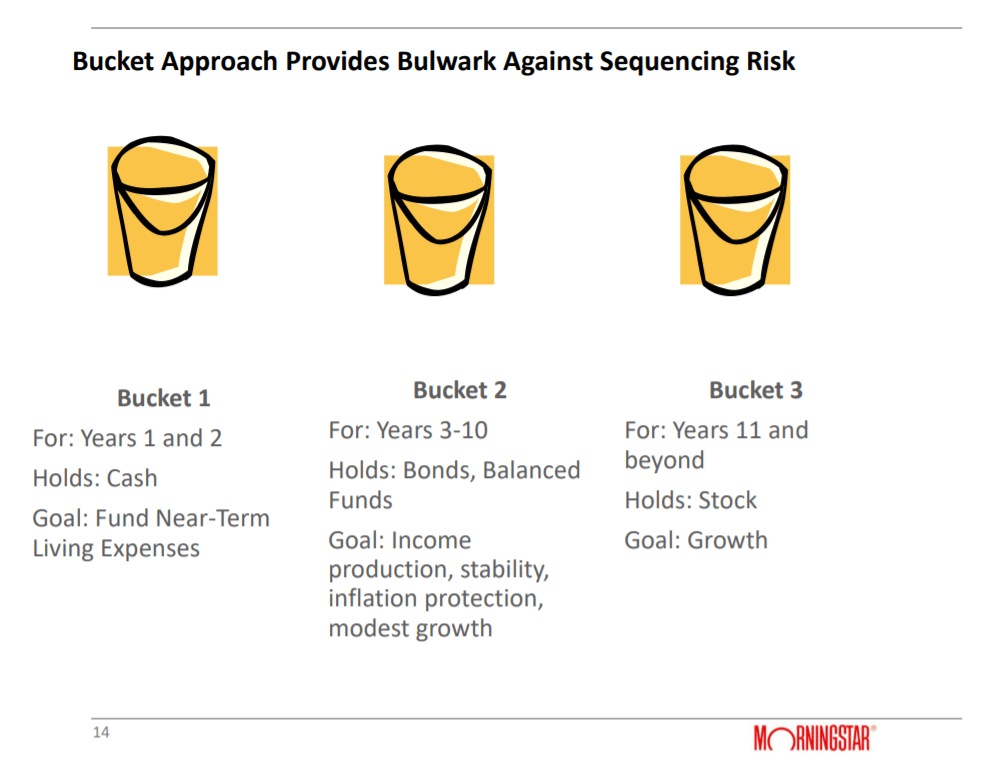

Although inflation has been less than 2% in recent years, the items that retirees spend money on (mainly healthcare and travel) are inflating at a higher rate than general inflation.

Ms. Benz says the way to overcome inflation risk is to make sure you own enough stocks. Over time, the stock market has increased more than inflation and should continue to do so.

I think you should also own some real estate investment trusts (REITs), and possibly Treasury inflation protected securities (TIPS) as part of your bond portfolio.

Another way to overcome inflation risk is to delay Social Security for as long as possible. Each year you wait to claim Social Security, your check increases by 8%. Since Social Security has a cost of living adjustment, waiting to claim will not only bring a bigger Social Security check, it will also bring larger increases each year.

Another strategy to overcome inflation risk is to purchase an inflation protected annuity large enough to cover your basic, necessary expenses. This guarantees you have at least your living expenses covered, no matter what the stock and bond markets do in a particular year.

Healthcare / LTC Risk

As we get older, we generally need more healthcare and unfortunately for older people, health care costs have been inflating faster than other living expenses. That means healthcare becomes an increasingly large portion of a retiree’s expenses as they age.

The way to overcome this is to stay healthy.

Financially the only way to overcome this is to budget for increasing healthcare expenses. There are no easy solutions to this. One thing working in favor of affording these higher medical expenses is that overall spending in retirement tends to stay constant because as we age, more is spent on healthcare, but less is spent on travel and activities.

Even if you have a Medicare Advantage plan with no monthly fee, the price of Part A and B, your deductibles, prescription costs, and out-of-pocket expenses are likely to increase each year. For 2020, the increase in Part B is 7%!

Another health care cost risk, that often isn’t thought about, is the fact that if you retire early, you have to go to the exchanges to buy healthcare insurance for the years between your retirement date and age 65 when you begin Medicare.

These rates are often well over $1000 a month for a couple. An additional $12,000 a year is a very large expense for a retiree. This additional expense is not just for those who have the means to retire early, those who are forced to retire early would have to go to the exchanges for health care as well.

Another risk is long term care risk. Long term care is not covered by Medicare or health insurance, and it refers to things you may need help with if your health has deteriorated or you’re old. Activities of daily living like bathing, getting out of bed, getting dressed, feeding yourself, etc.

In 2019, the average cost of one year’s worth of in-home health aide in San Diego County is $64,000. That is a significant expense and may be needed for many years. Nursing home care would cost even more.

The most common plan for long term care costs is to use home equity. If you don’t own your home, or don’t have a lot of equity built up, long term care needs could use up the vast majority portion of your portfolio.

There are long term care insurance plans available which are usually very expensive. To alleviate the worry that you’re going to buy long term care insurance and never need it, there are now combination/ hybrid long term care insurance plans with life insurance. This means either you will get the use of the long term care insurance, or your heirs will get a life insurance benefit if you pass without using all the long term care insurance benefit.

Longevity Risk

What if you have a nice long life and live to age 100 or more? That may seem unlikely or very far in the future, but if it could happen. For a couple, both age 65, there is a 31% chance (almost one-third) that at least one person will live to age 95. Future improvements in personalized medicine may increase these odds.

Financially speaking, living that long could take a toll. To overcome this risk, you need to put together a plan that uses all the available techniques.

Invest enough of your assets in stocks, use a total return approach, have a tax-efficient withdrawal strategy, maximize your Social Security and pension benefits, live within your means, and be flexible with your spending, consider annuities, and others.

Those are the 6 retirement risks and how to overcome them according to Christine Benz of Morningstar. If you have any questions about these risks, how they apply to your situation, or want some financial planning advice, please contact me.