What does a financial plan look like? (Updated 2022)

In this blog post I am going to show you highlights of a sample financial plan for a couple approaching retirement.

Each section of a financial plan from Andrew Marshall Financial, LLC includes a written discussion of the topic, my recommendation for your best course of action, the reasoning behind that recommendation, and data, diagrams, or other evidence to support the recommendation.

I am not going to show an entire financial plan here. In a financial plan, the discussion of each section can be extensive. This sample retirement plan was 13 pages when printed.

This post should still give you a good idea for what to expect when you hire us to create your financial plan.

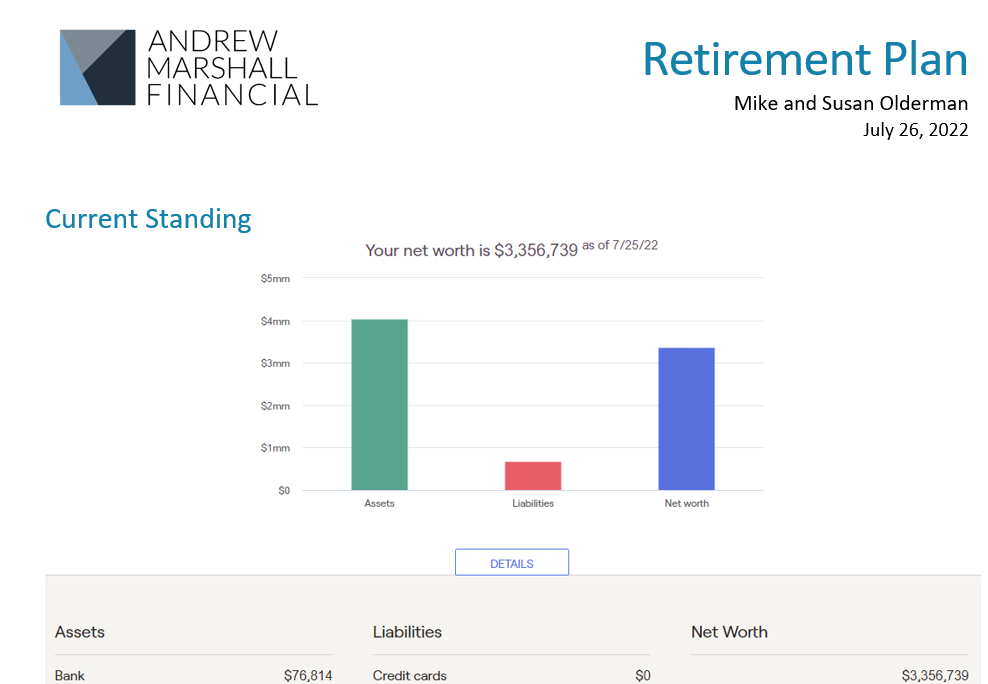

The sample financial plan we are going to look at here is for two clients named Mike and Susan.

Mike and Susan are baby boomers with two grown children who no longer require their support. Susan has just retired from Kaiser Permanente and Mike is still working.

Mike and Susan have been managing their finances on their own, but with retirement approaching, they want a professional opinion to confirm they can retire as expected and to make sure they are not missing something they are unaware of.

Let’s go through some highlights of their financial plan.

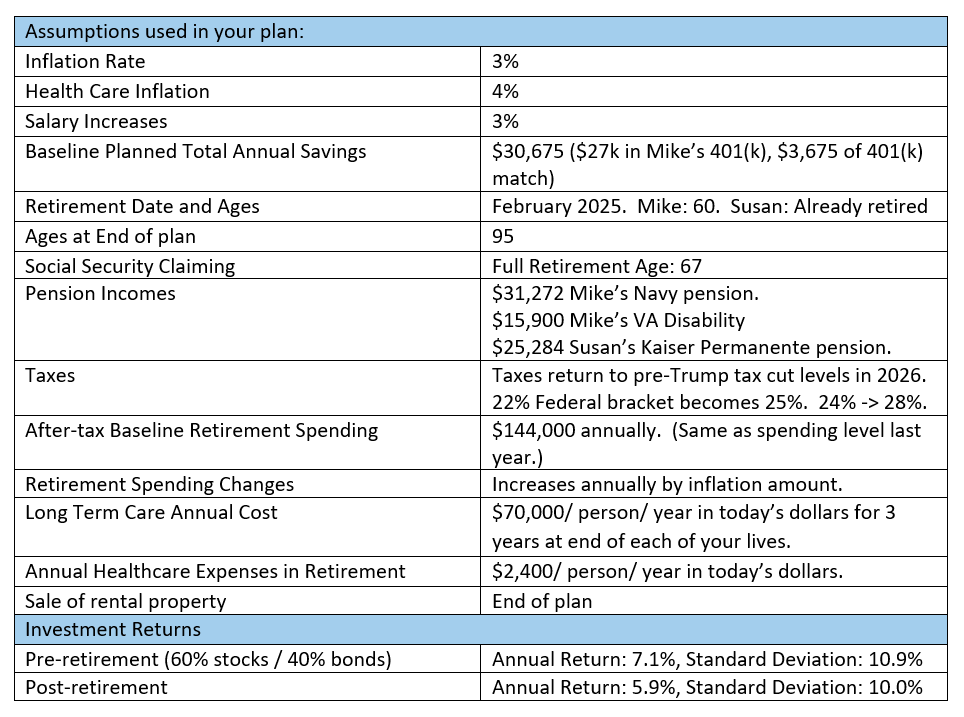

After looking at where they currently stand, we review some assumptions used in the financial plan.

Assumptions are an integral part of any financial plan. We must assume certain inflation rates, investment returns, savings amounts, life expectancy and others to be able to do the necessary calculations.

Those assumptions are laid out near the beginning of the plan, so they are known to all.

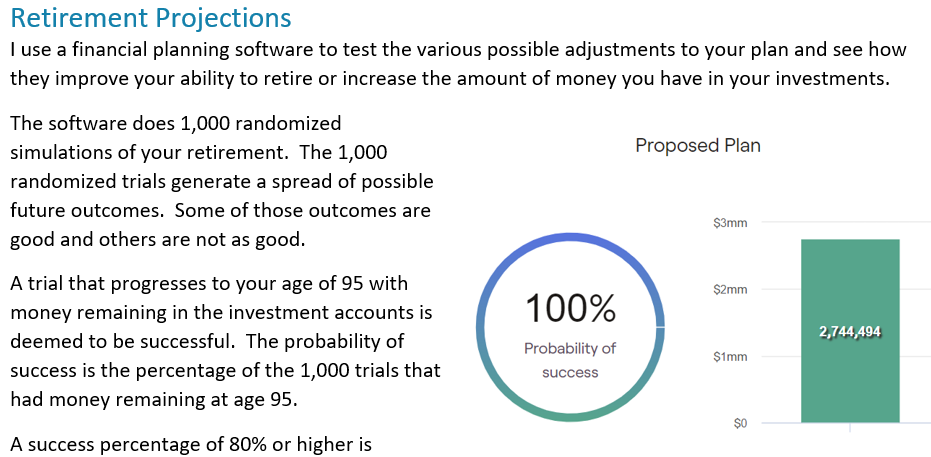

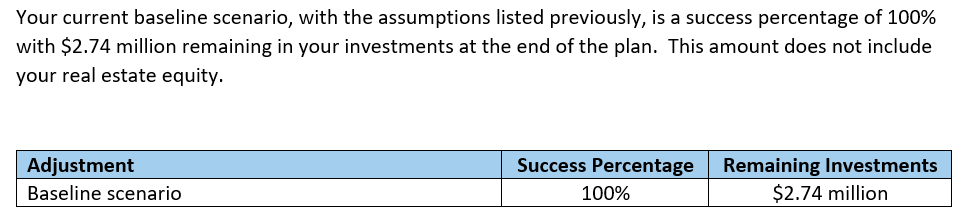

Our financial planning software does Monte Carlo analysis to project the probability of success in the future. In financial planning terms, this is the chance that you will still have money remaining in your investment accounts at age 95, with the assumptions above.

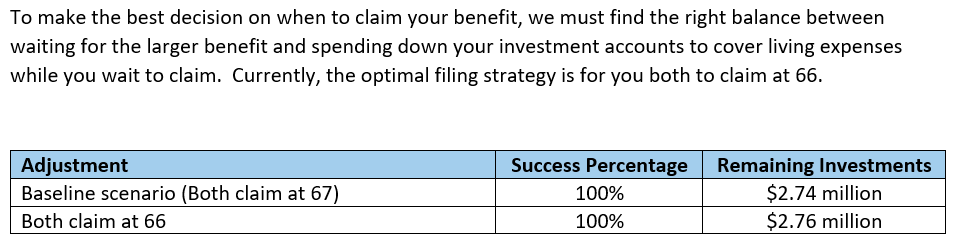

Using the assumptions and the software, we come up with a baseline scenario. For Mike and Susan the outcomes are excellent.

From here we can test various options and changes to what they are currently doing to maximize their retirement outcomes in terms of success percentage and ending assets.

The first topic is a discussion of Social Security claiming strategies and how those strategies impact the retirement plan.

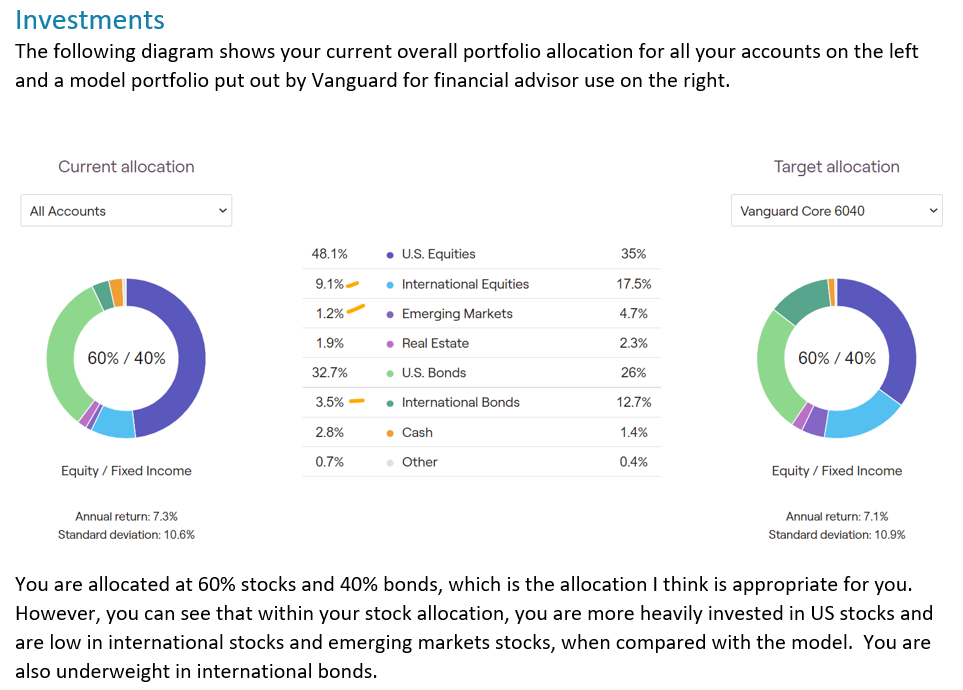

Every plan has a section covering investment review and analysis.

If you have multiple investment accounts like IRA’s, Roth IRA’s, 401(k)‘s, taxable accounts, and others, then I will review all of your accounts and create a cohesive plan that optimizes each account. A discussion of each account and the recommended adjustments is included. If selling and buying of funds are recommended, they are listed out by fund, amount, and account, to make it as easy as possible to implement the adjustments.

This sample plan includes a discussion of Susan’s pension options. This was a long, multiple page section explaining the risks and benefits of each option.

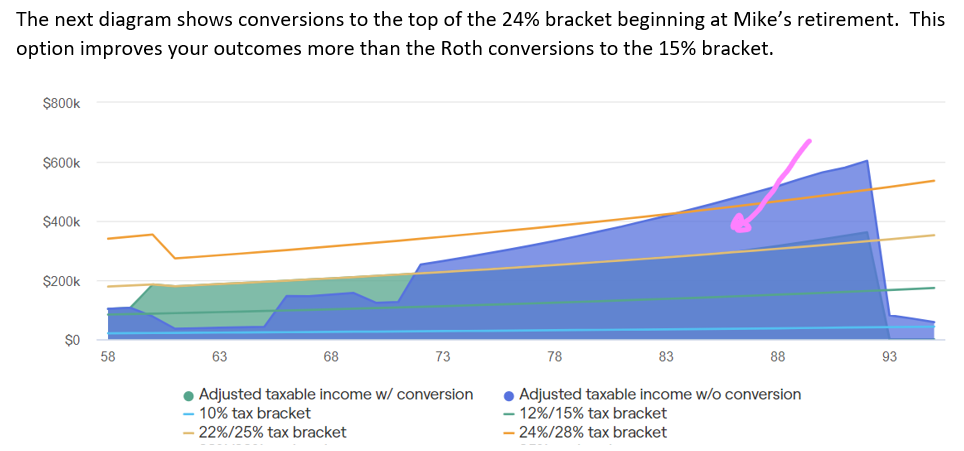

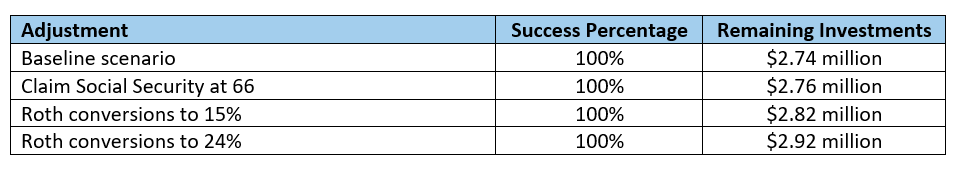

There is also a discussion about Roth conversion strategies and a chart showing how conversions would improve their retirement outcomes.

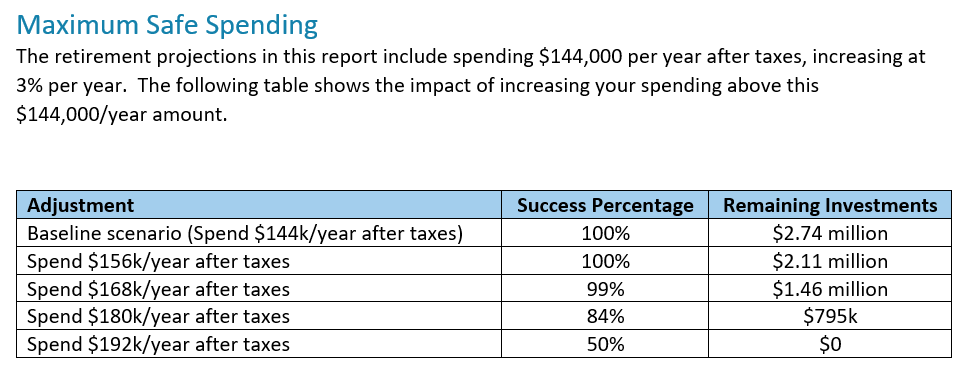

A popular topic is what is the maximum safe spending possible in retirement. The following graphic shows the impact of Mike and Susan increasing their spending in retirement.

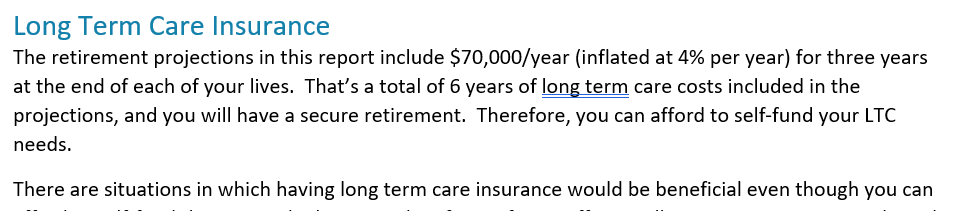

Finally, they were interested in long term care insurance. A discussion of the risks, a quote for long term care insurance, and a review of whether they can self-fund are included.

The culmination of all the analysis and discussions in this example financial plan is the creation of a written retirement plan that Mike and Susan can use to implement the changes and refer back to as needed.

The topics covered in your financial plan will likely be different from this sample retirement plan. Your topics are decided upon when we first meet.

Additional topics you may be interested in include:

- what account is best to save money in,

- how should you withdraw from your accounts once you retire,

- a review of your tax return,

- stress testing the success percentage,

- including a reverse mortgage at retirement,

- should you pay off your mortgage early,

- do you need to keep your life insurance policies,

- and many others.

As for future updates to your plan, I leave it up to you. I would recommend Mike and Susan update their financial plan each year to make sure they stay on track to retire. For an update, we will repeat the process of deciding what work you need done, generating a quote, signing a contract extension, and then doing the work.

If you would like to talk about creating your financial plan, call (760) 651-6315.

To get started immediately, complete this questionnaire and schedule your first meeting.