Are Schwab Intelligent Portfolios® the best robo advisor for retirees?

In this post I will explain why I think the answer is yes.

In this post I will explain why I think the answer is yes.

Charles Schwab Inc. is a huge investment company known for offering low cost investments. They are the original discount broker. With their recent purchase of TD Ameritrade, they will become an even larger company in the fall of 2020.

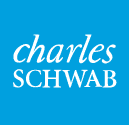

Robo advisors are automated, computer-based, systematic traders. A robo advisor is an investing tool that automates the ongoing account management steps that must be completed annually and when money is contributed or withdrawn from an account.

Robo advisors offer various investment allocations (stocks, bonds, etc.) and automatically re-balance the allocation according to certain rules.

The fact that there is a computer doing all the work means the cost is much lower than hiring a real person to oversee your investment management.

Robo investing can be very handy for someone who is in the accumulation stage of life. One can set up a direct deposit, say $1000 a month, from their checking account. The deposit goes to their robo advisor and the computers automatically invest that additional $1000 each month in the chosen allocation.

There is no effort needed once the initial robo account and $1000 monthly deposits are set up.

That saves a lot of time for someone who’s contributing additional money, but what about a retiree who is no longer making additional contributions and who has plenty of time to manage their investments?

Just like someone in the accumulation stage, a retiree in the decumulation stage would prefer not to spend the time to log into their accounts or make a phone call to withdraw money or to re-balance their accounts every quarter, 6 months, or even once a year. That’s just a hassle, and as they get older, it might get more difficult to handle.

Here are 7 reasons why Schwab Intelligent Portfolios® are the best robo advisor for retirees.

1. Intelligent Portfolios require a sizable allocation to cash.

Now you may not like the sound of Schwab requiring you to hold cash while they make money off your cash, but let’s think it through.

Most retirees I know are not aggressive investors and like having a sizable amount of cash available. Maybe their cash is in a high-yield savings account or CDs, but they almost always have one to two years of living expenses in cash.

Keeping a certain percentage in cash (even 10% or more) is actually not a disadvantage. It’s something retirees would be doing anyway.

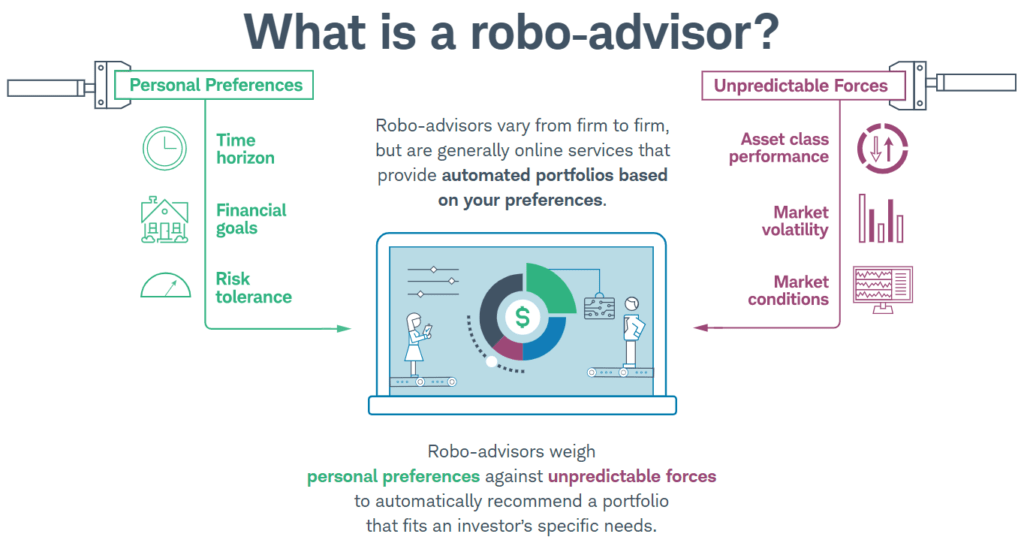

As long as the allocation to stocks is high enough, an Intelligent Portfolio investor is essentially swapping some bonds for cash (that cash earns interest at a current interest rate of 0.30% annually).

When opening an account, it is possible to adjust the stock allocation upwards to ensure enough growth in the account, even with a large cash allocation.

2. The fees = $0.

Obviously, a retirement account will last longer if one is not paying as much for investment management. One of the defining points about the Schwab intelligent portfolios is the fact there are no AUM (assets under management) fees! None!

Other robo investing tools such as Betterment, Wealthfront, TD Ameritrade Essential Portfolios, and others charge an annual fee of around 0.25% – 0.30% of the account value.

The reason Schwab does not charge a fee is they require a certain percentage of the account funds to be in cash. Schwab uses this cash to earn money for itself. This is not a problem for retirees – see number 1 above.

3. Schwab Intelligent Portfolios are the most diversified robo advisor I have seen.

Maximum diversification is a benefit for retirees.

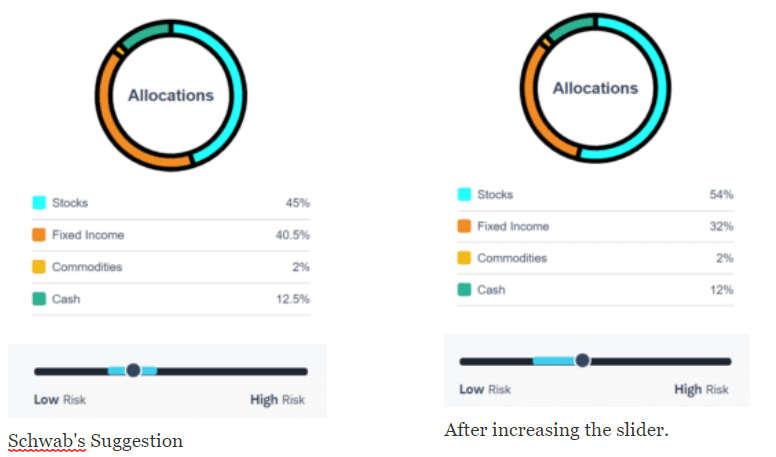

Schwab has created their own ETF’s that are not market cap weighted like typical index funds are.

Schwab has created their own ETF’s that are not market cap weighted like typical index funds are.

The size of each stock holding within these fundamental index ETFs is based on sales, cash flow, and dividends, not price.

The Schwab intelligent portfolios service spreads one’s investments between both market cap weighted ETF’s and fundamental index weighted ETF’s. That increases diversification.

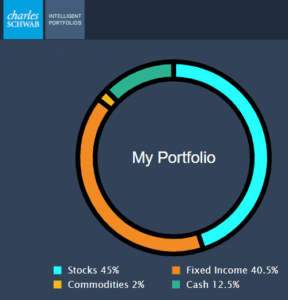

Schwab Intelligent Portfolios also spreads one’s investments across more asset classes than the other robo advisors. Schwab includes precious metals, REITs, emerging market bonds, high-yield bonds, securitized bonds, corporate bonds, international developed bonds and others. They use up to 20 asset classes.

Maximum diversification is the best strategy for retirees. Retirees should spread their risk to help maintain their account balance should one particular type of investment experience tough times.

4. Account rebalancing is done the right way.

Accounts are re-balanced only when an asset’s allocation has drifted too far from its desired percentage.

I like the fact it is not done on a regularly timed interval but rather on a results based interval.

For example, let’s say international stocks rise and become 25% of your portfolio instead of the desired 20%. The Schwab Intelligent Portfolios algorithm recognizes this, sells some international stocks to return them to 20%, and buys bonds or other assets to rebalance their allocations. That’s the best way to rebalance an account.

“Importantly, while portfolios are monitored daily, rebalancing occurs only as needed when an asset class drifts far enough from its intended weighting in the portfolio to warrant a rebalancing trade. That typically results in a couple of rebalancing events per year in an average market environment. In a more volatile environment, the number of rebalancing events might be a bit higher, and in a very calm market environment it might be lower.”

5. Automatic withdrawals can come each month to your checking account.

Beginning January 2020, Schwab is starting a new service named Schwab Intelligent Income. Schwab Intelligent Income works in conjunction with Schwab Intelligent Portfolios to calculate a safe withdrawal rate and transfer that amount from your investments to your checking account each month. That gives you the money needed to live on each month, as if you were still earning a paycheck.

6. Charles Schwab is a massive company.

You should feel comfortable investing with Charles Schwab because it’s too big to fail. One of the lessons of the financial crisis was the fact that the government can’t let huge financial institutions go under. It causes too many job losses and destroys confidence. The entire system is held up on confidence, so letting banks fail is not something the government will do anymore.

7. Easy access to your account info.

With the Schwab Intelligent Portfolios, you can access your accounts any time and any place that you have internet access. You can get on the Internet and see your account performance or make additional withdrawals and contributions as the need arises.

With the Schwab Intelligent Portfolios, you can access your accounts any time and any place that you have internet access. You can get on the Internet and see your account performance or make additional withdrawals and contributions as the need arises.

The automation behind these intelligent portfolios makes it easy to manage your money as you get older and perhaps have less ability or interest in managing your accounts. The automation also means you do not need to pay a full-time financial advisor an AUM fee to manage these accounts.

You can hire Schwab Intelligent Portfolios do it for free and feel confident those savings are going to make your accounts last longer.

Premium Service (Extra Cost)

Schwab Intelligent Portfolios Premium is an additional service that offers access to one of Schwab’s advisors over the phone for $300 up front and then an ongoing $30 a month ($360 a year). According to the website, the advisor is a CERTIFIED FINANCIAL PLANNER™ professional.

However, because the Schwab advisor works for a broker, they are not a fiduciary and are not required to put your interest first. In fact, they are employed by Schwab, so their incentive is to make their bosses happy.

This premium service is a competitor of mine so obviously I would not recommend this paid, premium service.

You should get your investment advice from someone who will not profit from your decisions and who is required by law to put your interest first. That’s a fiduciary. I am a fiduciary as a Registered Investment Advisor with the State of California. I am also a CERTIFIED FINANCIAL PLANNER™ professional.

If you would like to talk about finding the best investment manager for your needs or other financial planning topics please schedule a meeting or phone call here.