Financial Planning Process

The CFP board revised its Code of Ethics and Standards of Conduct effective October 1st 2019.

The CFP board revised its Code of Ethics and Standards of Conduct effective October 1st 2019.

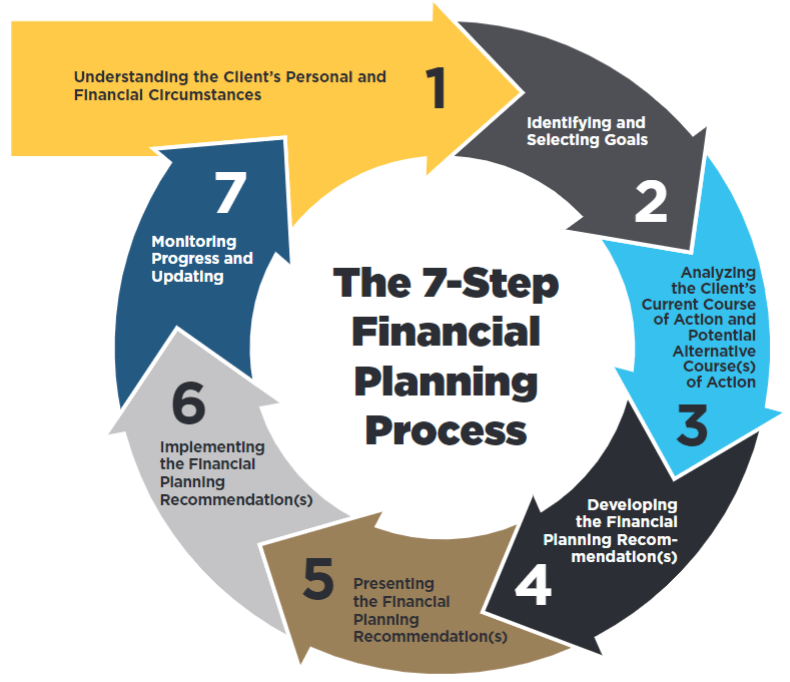

Part of this revision was an update to the CFP™ Practice Standards for the Financial Planning Process. This revised process is logical and makes a lot more sense than the previous version.

In this post, I will go through the seven steps to the revised financial planning process and show you how working with Andrew Marshall Financial, LLC (AMF) corresponds to each step.

Understanding the clients personal and financial circumstances.

The first step in the financial planning process is gaining an understanding of your personal and financial circumstances. How did you get where you are today? Who is important in your life? What assets do you have to work with in your next stage of your life journey?

To begin to understand your circumstances, I ask everyone who is considering working with AMF to complete a confidential questionnaire.

In the questionnaire I ask for some basic contact and financial information like: do you own a home, are you collecting Social Security, how many kids do you have, are you married, etc.

In the questionnaire I do not ask for any financial numbers. That way there is very little reason not to get started and fill out the questionnaire. It should take you 10 minutes or less to complete the questionnaire. A link is here.

With your questionnaire complete, the next method I use to understand your situation is to talk to you.

If you’re in the Carlsbad area, we can meet in my office.

If you’d rather not drive, or you’re not near the Carlsbad, California area, we can do a video conference. If you’re familiar with video conferencing at work or you have used Skype or FaceTime, you know it’s very easy to go online and meet as if we’re in the same room. The final option is a traditional phone call. Phone calls still work too.

This first meeting is free and what I want to do is hear your financial concerns, what you would like to accomplish, and determine how I can help you improve your future.

Identifying and Selecting Goals

Step 2 in the CFP Board’s financial planning process is to identify and select your goals.

You probably already know your goals before you come to see me. In our first meeting, we will talk about your goals. I may suggest some goals that you haven’t thought of but that will help your financial future.

Common goals people have are determining when they can retire, determining what their retirement spending will look like, having their investment allocation reviewed, and learning what steps they should be taking now to improve their futures.

With my help we will select and prioritize your goals. Hopefully all of your goals will be achievable, but if not, we may have to resize them or prioritize them.

After our meeting I will send you a written proposal listing out what your project will include and the price.

If you like the proposal and decide to hire me, then I will send you a contract for digital signature and collect a deposit.

After we are officially working together, my understanding of your personal and financial circumstances continues to expand.

I will collect the data needed to create your plan. Examples of the information I will collect include: your income, your spending, your risk tolerance, your account details, assets, liabilities, available resources, rental properties, taxes, employee benefits, government benefits, insurance coverages, and others.

Analyzing the client’s current course of action and potential alternative courses of action

Step 3 of the CFP™ planning process is when my work as a CERTIFIED FINANCIAL PLANNER™ professional really begins. At this stage, your input is complete for a while.

Using software, calculations, knowledge and experience, I will analyze your current course of action and create a projection for how things are likely to turn out for you should you continue as you currently are.

A baseline retirement projection is the most common example of this scenario. If you continue to save and invest as you are, you continue paying down any debts, and you retire at the age you want, what does your retirement look like? How much can you spend safely in retirement?

From this baseline situation I will test alternative courses of action to find ways to improve your outcomes. What changes to your finances will create a better future for you and your family?

My CFP™ training and experience has taught me how to analyze the different alternatives available to you and assemble them into a coordinated plan that maximizes the use of various elements and strategies.

Developing the financial planning recommendations

In step 4 of the revised CFP™ financial planning process, I will choose the best of the alternatives that I tested in the previous step to make my recommendations.

The term “best strategy” could mean many things including highest probability of not running out of money, highest net worth remaining for your heirs, highest average spending, easiest implementation, least complication, and others, depending on your wants.

In developing my recommendations, I will coordinate what the numbers tell me with what I know about you, your personality and your desires.

Once I have finished developing my recommendations, I will write a report detailing my findings, recommendations and the reasoning behind my recommendations. Click here to see sample report.

Step 5. Presenting the financial planning recommendations.

After I have completed your financial plan, we will meet again and go over the written report. I will explain each of my recommendations and answer any questions you have.

In some situations, we will connect my laptop to the large monitor on the office wall and show you how the variables affect your outcomes. For example, does spending $500 more per month make a difference? Does working one additional year make a difference? If so, how much?

As we play with the software and observe how the different elements of your financial plan interact with each other, you will come away with a great understanding of how your behavior today affects your future lifestyle.

Implementing the Financial Planning Recommendation(s)

Step 6 of the financial planning process is to implement the recommendations that you agree with. A financial plan that isn’t put into action doesn’t do any good.

When I make a recommendation for you, it’s just that a recommendation. If you don’t want to follow through on a recommendation, that’s up to you.

Hopefully I will have explained the reasoning for why my recommendations would benefit you, and you’ve asked questions, so you fully understand the recommendations.

Since I do not sell insurance and I do not manage investments, most all of the implementation will be done by you.

I can refer you to an insurance broker who works with fee only financial planners like myself, if that is needed. Also, I will make specific recommendations about funds that are available to you in your investment accounts.

For example if you have your accounts at Vanguard, I will recommend Vanguard funds for you. You can then log in to your account and make the necessary changes.

I will have analyzed your options for your 401(k) or 403(b) accounts and have made recommendations on the funds that are available to you. You can then take these recommendations, log into your 401(k) account or talk to your HR person at work, and make the changes.

In your written financial plan, I will make it clear which steps you need to implement and include instructions as needed.

Monitoring progress and updating

Since I do not charge an assets under management fee, I do not continually monitor your accounts. When you work with Andrew Marshall Financial LLC, each project is separate and the ongoing monitoring is up to you.

One way to integrate monitoring is for you to come back each year for an annual update.

During future updates we will look at how things have changed in your life and how your savings and investments have progressed. I may develop new recommendations or adjust the current ones.

I will leave it up to you to decide how often you want to come back for monitoring your progress and updating.

This really depends a lot on the client situation. I prefer to see clients who are approaching retirement each year because the retirement transition is so critical. For clients in the middle of their careers, perhaps they can come in every 2 or 3 years.

If something changes in your life like a new job, an illness, new baby, you buy a home, etc. There are lots of things that change in life and may necessitate a progress update for your financial plan.

I hope this blog post has shown how the process I follow aligns with the financial planning process according to the new CFP board standards of conduct.

If you are ready to get started please fill out the questionnaire (link here) and schedule your first meeting (link here).