The Best Method for Managing Your Own Retirement Investment Portfolio

Your investment portfolio during retirement must be able to handle several issues.

- It must allow for withdrawals sufficient to cover your lifestyle

- It must increase enough to overcome inflation

- It must not sell stocks when the market is down

- It must have safe investments, so your money is there when you need it

These four tasks can sound difficult, but there is a method which can achieve them.

The ideas described in this blog post come from a book titled “Living Off Your Money” by Michael H. McClung. I was very excited to read this book because it solves one of the great misconceptions I think exists in financial advice.

The ideas described in this blog post come from a book titled “Living Off Your Money” by Michael H. McClung. I was very excited to read this book because it solves one of the great misconceptions I think exists in financial advice.

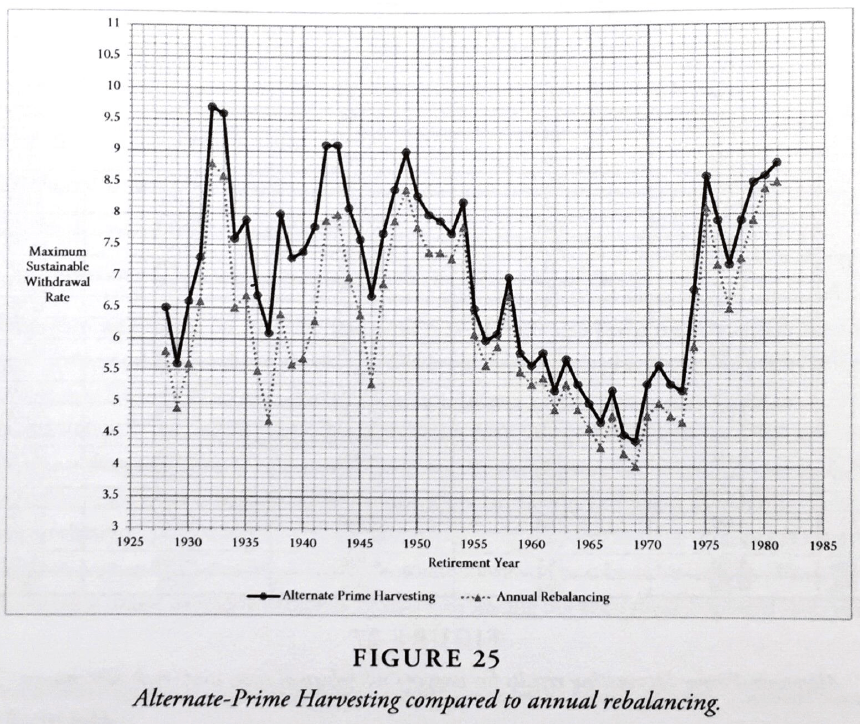

That misconception is the idea that account rebalancing is helpful to client account size. It is not. The Living Off Your Money book details a better way to manage a retirement portfolio. Mr. McClung’s new strategies are named Prime Harvesting and Alternate Prime Harvesting. They are very similar, just the amount of stocks that are sold is different. Both improve on typical rebalancing.

Typical Account Rebalancing

As someone who has studied investing and traded in stocks and futures using a trend-following technique, I know that stocks making new highs tend to continue making new highs. It is by letting these winners run that big gains are made. Selling early in a big run up cuts these gains off before they become significant.

A financial advisor or investor using the typical account rebalancing techniques each year will sell the best performing asset each year because that asset (stocks or bonds) will be a larger percentage of the portfolio by the fact that it outperformed the other asset that year. So, if stocks have a good year, and say they have risen to 60% of the portfolio when a 50/50 portfolio is desired, then stocks will be sold that year to fund withdrawals. That leaves fewer shares of stock funds owned, thereby limiting returns, if stocks have another good year.

But is there a better way? One with some data behind it to prove that it is better?

Income Harvesting

Michael McClung uses the term income-harvesting strategy to describe the process of funding withdrawals. What is an income-harvesting strategy?

Income-harvesting strategies “specify what’s sold to fund withdrawals, what triggers rebalancing, and how rebalancing takes place.”

Mr. McClung’s idea, which I think is genius, is to sell bonds to cover your living expenses. He only sells stocks when they are up an inflation adjusted 20% from the last time stocks were sold. He names his strategy Prime Harvesting and has a similar one named Alternate Prime Harvesting.

Not selling stocks to fund withdrawals means you are not forced to sell in down years. Furthermore, you are letting your winners run because you wait until you are up 20% before selling.

Sell bonds, then replace the bonds if the stock market has been doing well. Repeat for your lifetime and you have nothing to worry about. Now that’s genius.

Let’s now go through the four tasks of a good retirement investment strategy listed above and see how Mr. McClung’s new strategy outperforms the traditional financial advisor techniques.

First, it must allow for withdrawals sufficient to cover your lifestyle.

The rule of thumb for investment portfolio withdrawals in retirement is to take 4% from the account the first year and then adjust that amount for inflation each year. For example, you retire with $1 million. The first year you retire you can take $40,000 ($1,000,000 x 0.04) from your account. During that first year, say inflation was 2%. In year two, you can take $40,800, regardless of your portfolio value. That’s what is commonly referred to as the 4% rule.

The 4% rule came about because William Bengen in 1994 studied historical investment data to determine the maximum safe withdrawal rate. He found that one could safely withdraw 4% in the first year and never run out of money for a 30-year retirement.

Can the 4% ultimate safety rule cover your retirement lifestyle? That depends on the amount you have saved and the amount you will spend in retirement.

Assuming you have enough to retire, the issue with this technique is that although it is safe, is it too safe? Would you rather die with a lot of money in your portfolio or spend more and therefore enjoy your retirement more while still being safe? Optimizing the withdrawal rate can solve this dilemma.

To be clear, we still want a safe withdrawal rate, we just want to be smart about it. The 4% rule exists because you would be safe from all past market conditions using standard portfolio rebalancing. There was only one year (if you retired in 1969) where you would have been extremely close to going bankrupt.

Some years (if you had retired in the early 1930s or 1940s) you would have been able to safely withdraw over 8% per year. Withdrawing 4% when you could have safely withdrawn 8% shows that planning for the ultimate worst case may not provide us with the most enjoyable retirement.

Using Mr. McClung’s Alternate Prime harvesting method raises the safe withdrawal to 4.4% and improves on the standard rebalancing techniques in every retirement year tested.

The second task for a retirement investment system is you must keep up with inflation. Solving this issue is dependent on your asset allocation. In retirement, people want to be safe. It’s human nature to become more conservative as we age. People don’t want to risk the savings they worked their entire life for.

The real risk however is that by not putting enough of your account in stocks, you are almost guaranteeing a decrease in lifestyle later on. Without stocks, inflation will eat at your portfolio. The $40,000 you can safely withdraw from the $1 million portfolio mentioned above, will buy only half as much as today in twenty years.

The proper allocation for you can be determined, but for those people who have enough saved, an allocation to 50% stocks and 50% bonds is safe. Sixty percent stocks and 40% bonds produced the highest likelihood of not running out of money in Mr. McClung’s testing.

For task number 3, stocks must not be sold when they are down.

Selling stocks when they are down is not the best way to fund your retirement spending for two reasons. Stocks tend to trend higher and getting your account back to even requires a larger percentage gain than the loss.

After a loss, if the percentage gained is equal to the percentage lost, the account does not return to its original level. If you lose 10% and then gain 10%, you will not be back where you started.

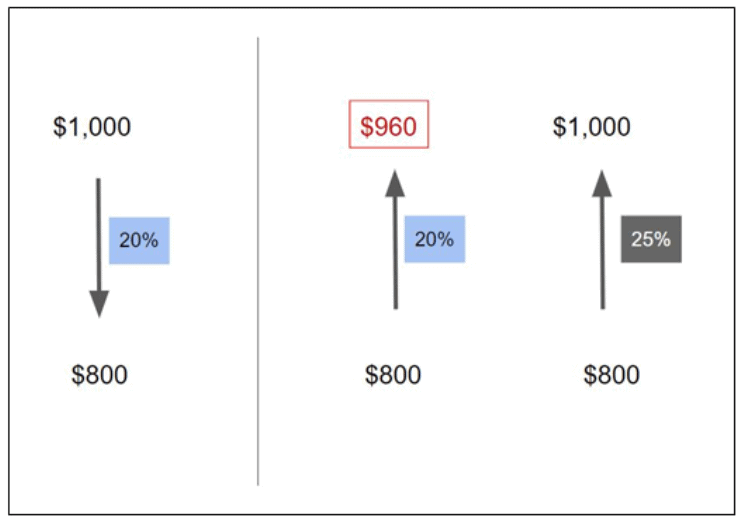

If you start with an investment at $1000 and it goes down 10%, it’s now worth $900. If this $900 investment has a 10% gain, then it is worth $990, not the original $1000. To get back to 100 after a 10% loss, you must gain 11.1%!

This incongruence of percentages is more dramatic with larger losses. The larger the loss, the larger the subsequent gain must be just to return to the starting level.

A 20% loss requires a 25% gain to return to even. A 30% loss requires a 42.8% gain. If your loss goes to 50% (as the S&P 500 did in 2008 to 2009) you must then double your money to break even!

Taking withdrawals from stocks magnifies the losses. If you sell stocks to withdraw 4% when the stocks are down 30%, you are now down 34%. That means to get back to where you started, your account will need to gain 51% rather than 42.8%.

The fact that investment gains must be larger than the losses makes selling stocks when they are down extremely detrimental to maintaining an account of sufficient size.

This issue is overcome by Mr. McClung’s Alternate Prime Harvesting method of selling bonds to fund withdrawals. Those bonds are only replaced from the sale of stock when the stocks are up an inflation adjusted 20%. By following his rules, you only sell when stocks are up.

Money Must be Available When You Need It

By selling bonds first, you have a safe source of money available. The current performance of the stock market is irrelevant.

Actually, you can think of bonds as being a savings account of sorts. If bonds are like a savings account, how many years of savings do you feel you need to have sat in bonds?

With a 50/50 portfolio, you have 50% of your portfolio in bonds. If you withdraw 4% each year, then the portfolio contains 12.5 years of withdrawals. That sounds safe to me. Twelve years of expenses covered and sitting in safe bonds. The stock market will likely have grown in twelve years. During those twelve years, you will have replenished your bonds. So why worry about the stock market or running out of money in retirement?

There are more details to these retirement investing ideas, but I think you get the idea that it is possible to accomplish the four points of a great investing system for retirement.

If you have questions about this retirement income investing system, or other financial planning topics, please give us a call at (760) 651-6315.