In February, I attended two days of insurance training in Clearwater Beach, Florida. I don’t sell insurance, but part of creating a comprehensive financial plan is understanding if clients are fully covered by their various policies.

Two training sessions were on long term care insurance policies (LTCi). I came away from the sessions with an understanding of the risk a couple is taking by going without long term care insurance and the tax benefits of owning a policy.

Risks of Not Owning LTCi

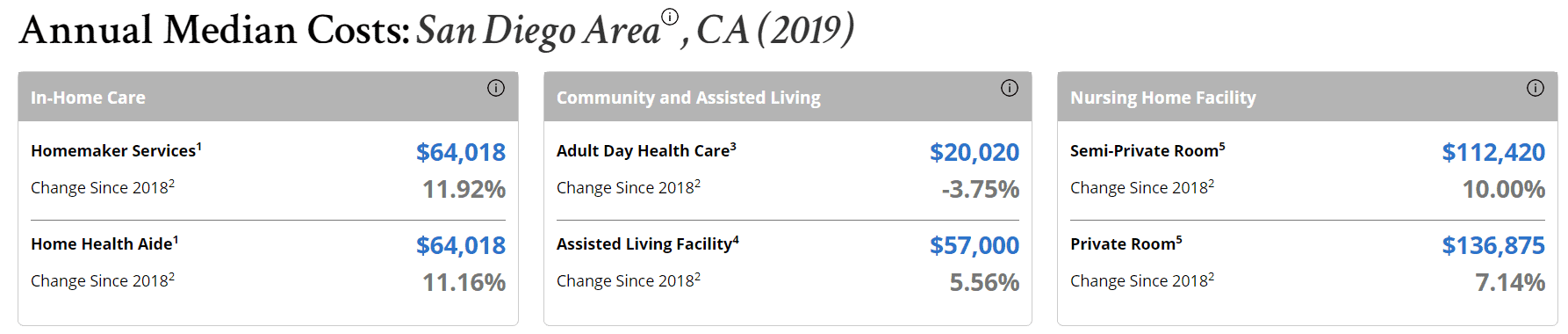

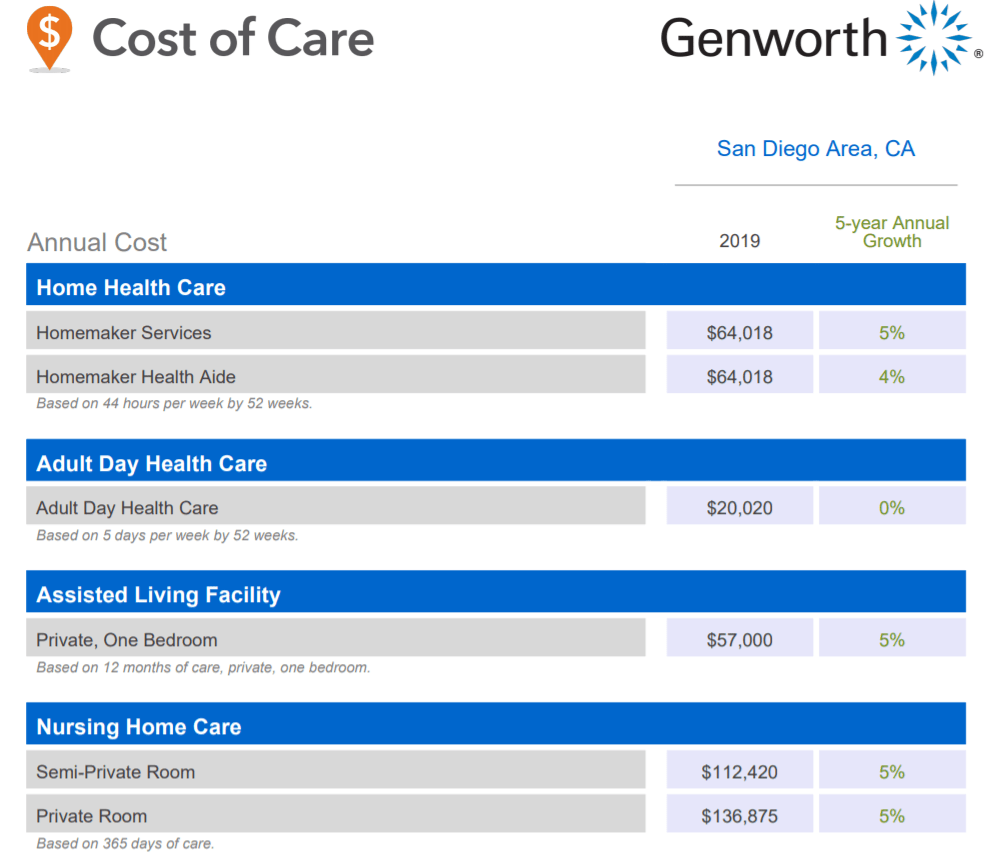

We all know that health care costs are increasing rapidly each year as are long term care costs for all types of care: in-home, assisted living facilities, and nursing homes. The costs are shocking when you first hear them. Here is a link to a website that will show you an estimate for the price in your area of the country: Genworth Cost of Care Survey.

The general strategy that most retirees are using for LTCi is to wait and see. They plan to use their investment assets or their home equity to pay for any assisted living or nursing home costs.

I have generally gone along with this idea but realize now that this will only work well under certain conditions. Those conditions include having a sizeable net worth, when there are no goals for passing assets on to kids or charities, and when the long-term care is needed after one spouse has already passed away.

The big risk of not having LTCi is, how will the healthy spouse’s life change after paying for the long term care needs of their spouse?

Commonly, the healthy spouse will look after the ill spouse at home for as long as possible, but it eventually gets overwhelming. The physicality of transferring someone into and out of a shower or a bed is really hard work. The time and effort spent being a caregiver really depletes the caregiver’s quality of life. As the caregiving spouse gets older, the more likely a need to hire someone will arise.

If they use their investments or tap their home equity to pay for it, then the resources remaining for support of the healthy spouse’s life can get depleted quickly. This will leave the remaining spouse with a very different lifestyle than what they were used to or what they dreamed of as retirement living, before their spouse became sick or incapacitated.

Let’s look at some financials to see what the aftermath of a nursing home stay could be.

Long Term Care Costs for an Example Couple

The average time spent in a nursing home is 18 months. The median (or middle) time is 6 months. There are some really long stays that pull the average out.

Let’s look at an imaginary example and say the male of our married couple had a stroke and didn’t recover well. He had to be moved into a nursing home and was able to stay alive for two years thereafter.

The total cost for two years in a San Diego area nursing home is $273,750. If this couple uses their investments to pay for this nursing home, how much will it actually cost them?

By using their investments to pay for it, long term care needs could actually become 20% to 50% more expensive. Why? Their tax rate.

Depending on the tax bracket and what type of account the investments are in, withdrawing to cover LTC expenses will create taxable transactions.

Best Account Types to Pay for Long Term Care

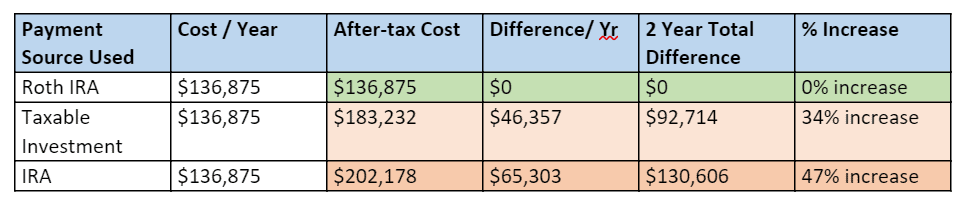

The best option is to use a Roth IRA account. There are no taxes due on a Roth IRA withdrawal.

The next best option is to pay capital gains tax on withdrawals from a taxable investment account. This will most likely be taxed at a rate of 15% Federal, plus state taxes.

The costliest option would be to pull from an IRA account. IRA withdrawals are taxed as ordinary income.

Chart of After-tax Long Term Care Costs

We will assume our example couple is in the 22% federal tax bracket. That corresponds to a 2020 annual taxable income level of $80,251 to $171,050. In this tax bracket, long-term capital gains would be taxed at 15%. For both types of taxable withdrawals, the California State income tax would be an additional 10.3%.

Cost of care per year: $136,875

This chart shows the dramatic increase in actual cost they would pay after tax for self-funding a nursing home stay. $202,178 versus $136, 875. A 47% increase on already expensive care!

Two ways to minimize the cost of a nursing home stay are to use a Roth IRA (if it is large enough) or own an LTC insurance policy. With a long-term care policy, the costs are paid by the insurance company, and you receive those benefits tax free!

That leaves the investment accounts untouched and able to continue growing and supporting life’s other expenses.

Long Term Care Insurance Premiums

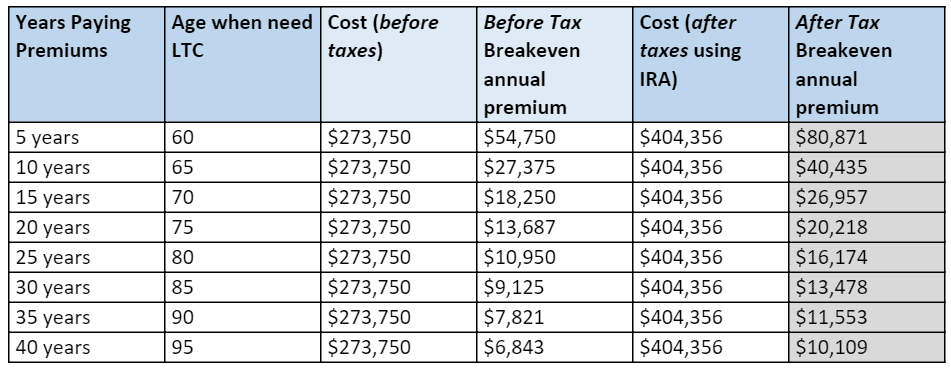

When we are comparing the premiums for a LTCi policy with self-funding, we must compare the after-tax cost of self-funding care to make a valid comparison.

The total cost for two years of nursing home care in San Diego county in this example is $273,750. How much would premiums need to be to come out ahead?

If this couple buys a policy at age 55 and the gentleman needs his two years of care after X years, let’s look at a simplified example to see what premium amount they could pay and still come out ahead on an after–tax comparison basis. (This chart is simplified because premiums and cost of care are not increasing with inflation.)

If their premium is lower than the column on right, they come out ahead by purchasing long term care insurance in this example.

The caveat being that premiums will increase as time goes by. But, so will the cost of care. Investment account values may not increase enough to keep up.

By buying LTCi, they are passing the risk of affording the future costs to the insurance company rather than trying to keep up with the costs through their own investment accounts.

If costs rise by 5% annually for LTC, as they have been doing, then their investment account must also increase that fast. For an investment account to average a 5% or larger return, it requires a large allocation to stocks. Perhaps more than most retirees are comfortable with.

Conclusion

Owning long-term care insurance can effectively protect the lifestyle of the remaining spouse.

There are more variables to look at than are discussed in this post, but the idea is to show you that incorporating long-term care insurance in your financial plan may be worth a close examination.

Ready to get started on your financial plan? Click here to schedule a free, first meeting.