You’ve probably heard or read that you should wait until age 70 before claiming Social Security. In this blog, I’m going to show you actual numbers, so that you can see just how much of a difference delaying Social Security can make.

The details of our scenario are Diane is turning 62 in November and retiring. She is single and has never been married. This keeps the scenario simple because there are no spousal benefits involved. Her Social Security full retirement age benefit is $3,163 per month at age 67. To get that large of a Social Security benefit means that she has been a high-income earner for many years. I am going to show you how much she will receive if she claims at age 62, 67, and 70.

The details of our scenario are Diane is turning 62 in November and retiring. She is single and has never been married. This keeps the scenario simple because there are no spousal benefits involved. Her Social Security full retirement age benefit is $3,163 per month at age 67. To get that large of a Social Security benefit means that she has been a high-income earner for many years. I am going to show you how much she will receive if she claims at age 62, 67, and 70.

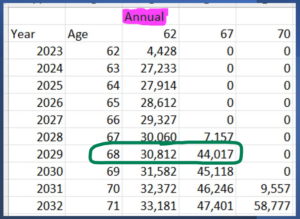

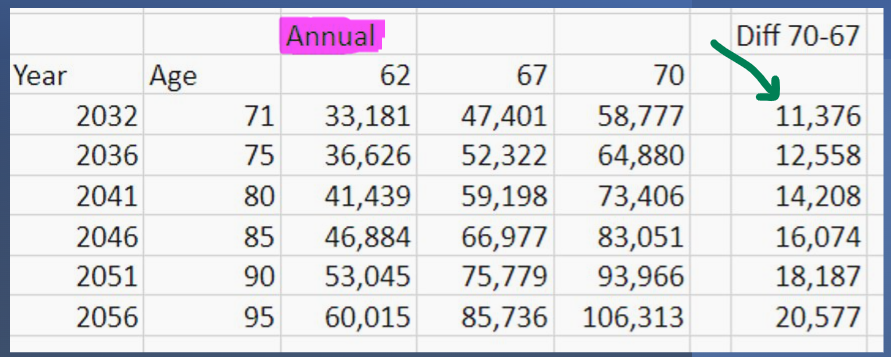

The following spreadsheet shows the annual amounts under different claiming ages.

If she claims at 62, in her first full year of benefits she will receive $27,233. That amount with cost-of-living increases (which are assumed to be 3% per year) increases to become $30,812 per year by age 68.

If she delayed claiming to 67, instead of receiving $30,812, she would receive $44,017 that same year.

That’s a big difference!

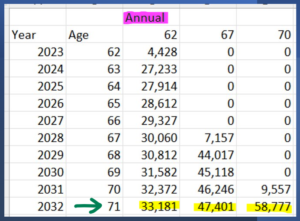

Continue down to the bottom row and look at the year she turns 71.

If she claims that 62, she’ll be receiving $33,181 per year. If she claimed that 67, she would receive $47,401 per year while claiming at 70, she would receive $58,777 per year. That’s a significant difference!

Can she afford to wait?

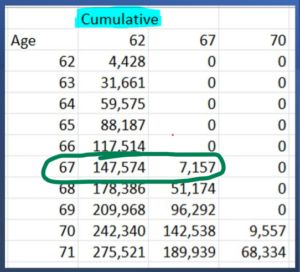

If Diane is going to wait until age 67 to claim Social Security, she must have money set aside or other income to live on. This next spreadsheet shows that she would have received $140,000 by the time she is 67. This was calculated by adding up the benefits received each year.

If she does not have a way to pay $140,000 of bills, then waiting is not even an option. She has to claim early.

If she does have money set aside in a bank account or in a brokerage account, then she can afford to wait to claim her Social Security. Most often the breakeven point comes around age 79 years’ old.

So, if Diane is going to live past age 79, she should delay her Social Security benefits.

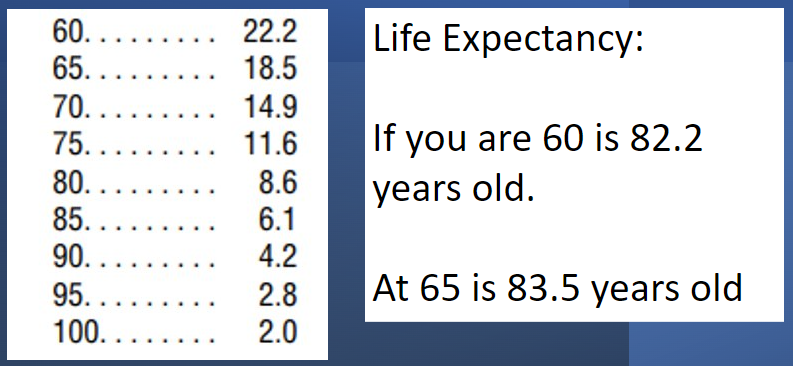

Life Expectancy

If age 79 sounds like old age that you’re unlikely to reach, well life expectancy tells us that half the population who are currently 60 are going to live past age 82.2. The odds of living into your 80s are even better if you’re already 65.

Cost of Living Adjustment (COLA)

Another thing I want to point out about Social Security benefits and the advantage of waiting to claim is that the difference increases each year as you can see on the right-hand column of the following spreadsheet. The reason the benefit difference increases each year is that Social Security gives a COLA. A cost-of-living increase that’s a percentage amount.

A 3% increase on $58,000 is larger than the 3% increase on $47,000. Over time the COLA increase compounds, so that the difference is increasing for each year that you stay alive.

If we look at the age 90 row, we can really see how big of a difference waiting to claim Social Security makes if one lives a long life.

In this example, claiming at the various ages would be $53,045 versus $75,779 versus $93,966. That’s a really big difference!