Currently, my favorite stock ETF is the Invesco Russell 1000® Dynamic Multi-Factor ETF. The ticker symbol is OMFL.

Let’s go through the name of this ETF and see what each of the parts means.

Invesco is a large investment company which manages this fund. They manage $1.4 trillion dollars in all their funds combined.

Russell 1000 is a stock index. You’ve probably heard of the S&P 500 Index. Well, the Russell 1000 index covers the same 500 stocks as the S&P 500 plus the next 500 largest stocks.

Dynamic means that the holdings in this fund change according to predetermined triggers. With a standard index fund such as the S&P 500, the holdings change infrequently. OMFL on the other hand is reconstituted and rebalanced monthly based on various economic indicators.

The way this works is that each of the 1000 securities are assigned a multi-factor score for each of five investment styles. Those styles are value, momentum, quality, low volatility, and size.

Depending on which stage of the economic cycle we are in, the fund overweight’s two or three of the five factors.

The bottom of this diagram shows that in an economic recovery phase the fund would emphasize size and value. When the economy moves into an expansion phase, the fund would add stocks that ranked high in the momentum score along with size and value.

Where we are now, in an economic slowdown, the fund should be invested in companies that scored high in quality and low -volatility.

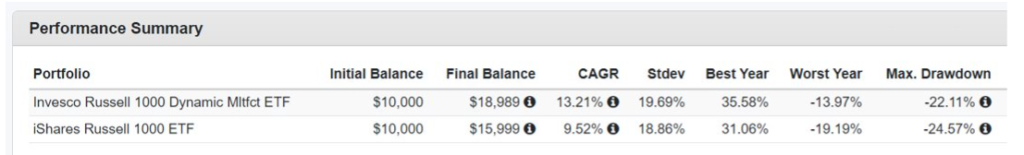

Using PortfolioVisualizer.com, we can check and see how this OMFL fund has compared in performance to the iShares Russell 1000 ETF (symbol IWB), which is a standard Russell 1000 ETF.

This result is showing from 2018 until March 2023. Ten thousand dollars invested in January 2018 would now be worth almost $19,000 if it was invested in OMFL and $16,000 if it was invested in the standard Russell 1000 Index fund. That’s a big difference! 3.7% annually.

The standard deviation was higher, but the best year was larger than the standard index. The worst year it lost less, and the max drawdown was less.

This next diagram shows annual returns by year. The blue bars are the OMFL fund, and the red bars are the standard fund.

You can see that in every single year the blue bar is better than the red bar.

In 2018 there was a trade war with China and the stock market was negative for the year. OMFL lost less that year than the index. (OMFL: -2.57%, IWB: -4.88%)

In 2019 the economy was growing quickly, and the stock market did very well. OMFL did even better. (OMFL: 35.58%, IWB: 31.06%)

In 2020 Covid shut down the world economy. In one year, we went from growth to recession and back to growth when the government stimulated the economy. In 2020 OMFL did slightly better than the standard index fund. (OMFL: 20.96%, IWB: 20.77%)

In 2021, a growth year, OMFL beat the Russell 1000 again. (OMFL: 28.96%, IWB: 26.32%)

Last year the index was down big. OMFL lost less. (OMFL: -13.97, IWB: -19.19%)

So far this year in 2023, OMFL has beaten the index again. (OMFL: 7.13%, IWB: 4.1%)

OMFL has been in existence for more than five years and it has beaten the index in every stage of the economic cycle. I think that’s really impressive, and it shows that the rules that govern this fund’s reconstitution are effective.

One thing we haven’t seen is how OMFL performs in range-bound markets. A range bound stock market is one that oscillates between a high and low for months at a time without really moving higher or lower.

The stock market has been trending up or down in the last five years. In these two stock charts, we are seeing the iShares Russell 1000 Index Fund (IWB) on the left and OMFL on the right. They both are showing five years’ worth of returns.

IWB on the left is up 49.65%. OMFL, in the exact same amount of time, is up 76.12%. That is a big difference.

If you are looking to invest in a fund that has a good chance of performing better than a standard index fund, then I think you should consider researching this Invesco Russell 1000 Dynamic multi-factor fund symbol OMFL further.

Remember that just because this fund has outperformed the index in the past, does not mean this fund is guaranteed to outperform the index in the future.

Also, this is not a recommendation to buy this fund. This is not personalized financial advice.

If you would like personalized advice, please schedule a free, first meeting with me using this link.