It is important to understand that just because the stock market has done very well in recent memory (2022 excluded), does not mean that will always be the case. It can be easy to assume that stocks always go up faster than everything else. However, it is entirely possible that 2022 turns out to be similar to 2000 and the next 12 years parallel 2000 to 2012.

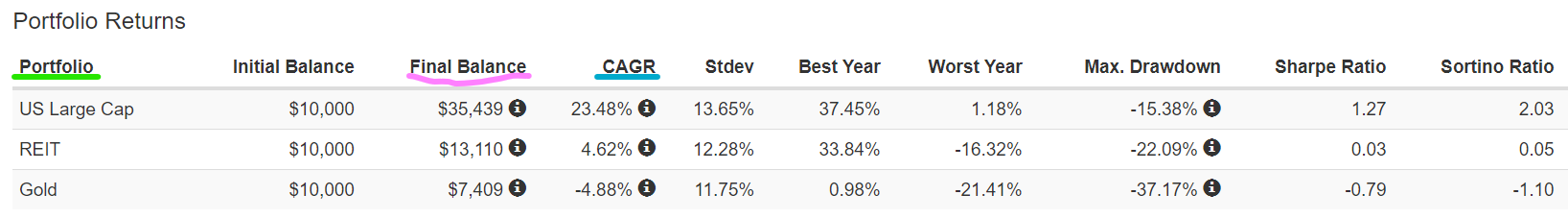

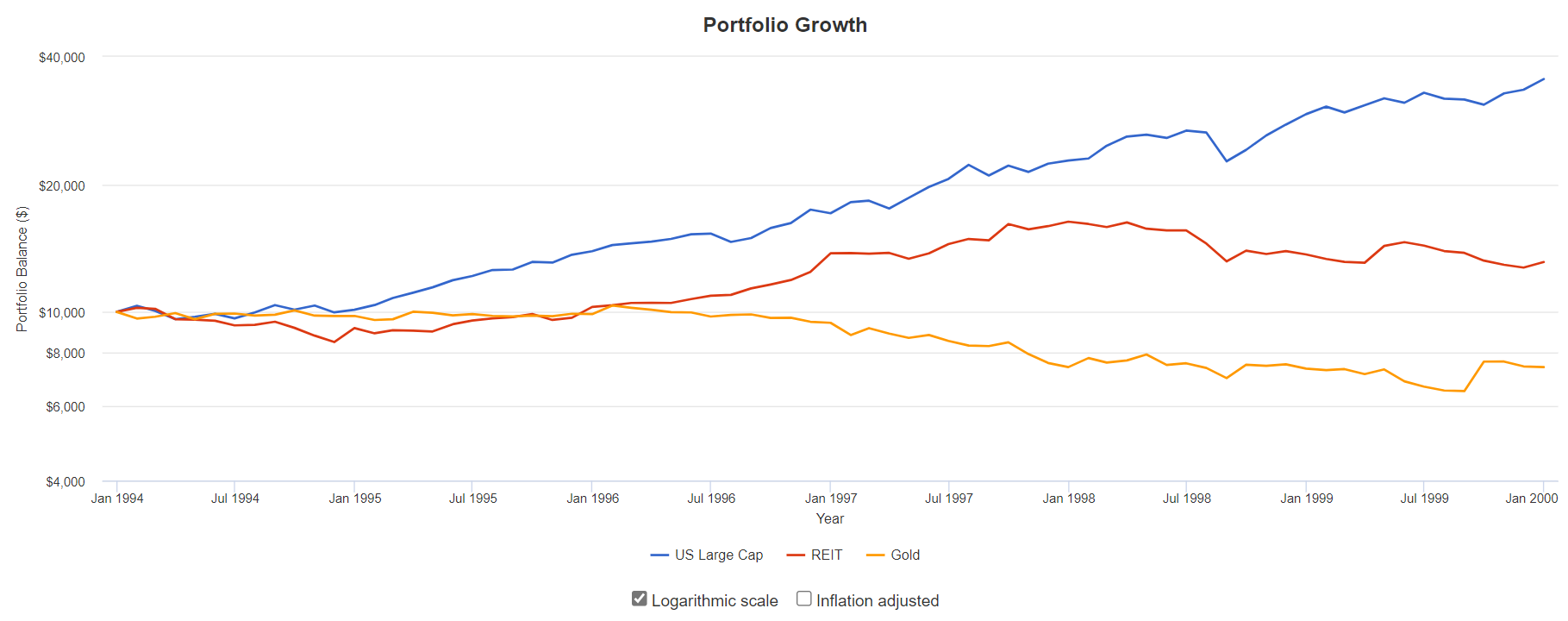

The following graph shows the performance of three asset classes from 1994 through the end of 1999. They are large cap stocks (such as the S&P 500), real estate, and gold. The blue line shows stock returns, the red line shows real estate and gold is the yellow line.

By December 1999, $10,000 invested in stocks in January 1994 would have turned into $35,439. A $10,000 investment in real estate investment trusts would be worth $13,110 and $10,000 invested in gold would have gone down in value and would have been worth $7,409.

Someone investing additional money at the start of 2000 probably would have felt that the best investment was the stock market. After all, investors more than tripled their money in stocks over the previous six years. It would have felt like the stock market was bound to continue going higher and investing in gold or real estate was sure to limit their investment portfolio returns.

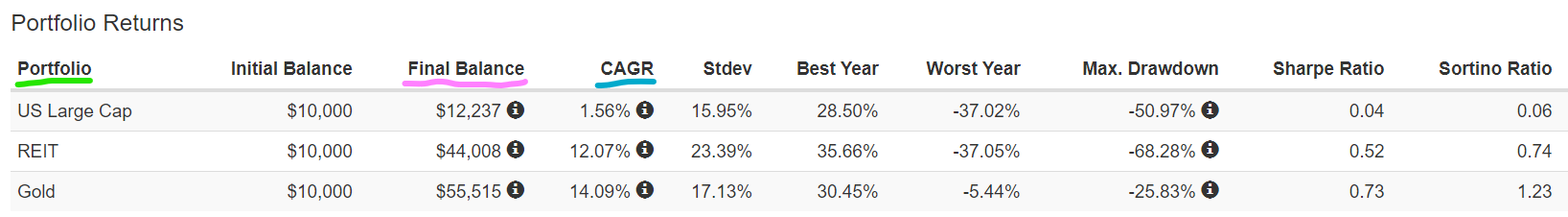

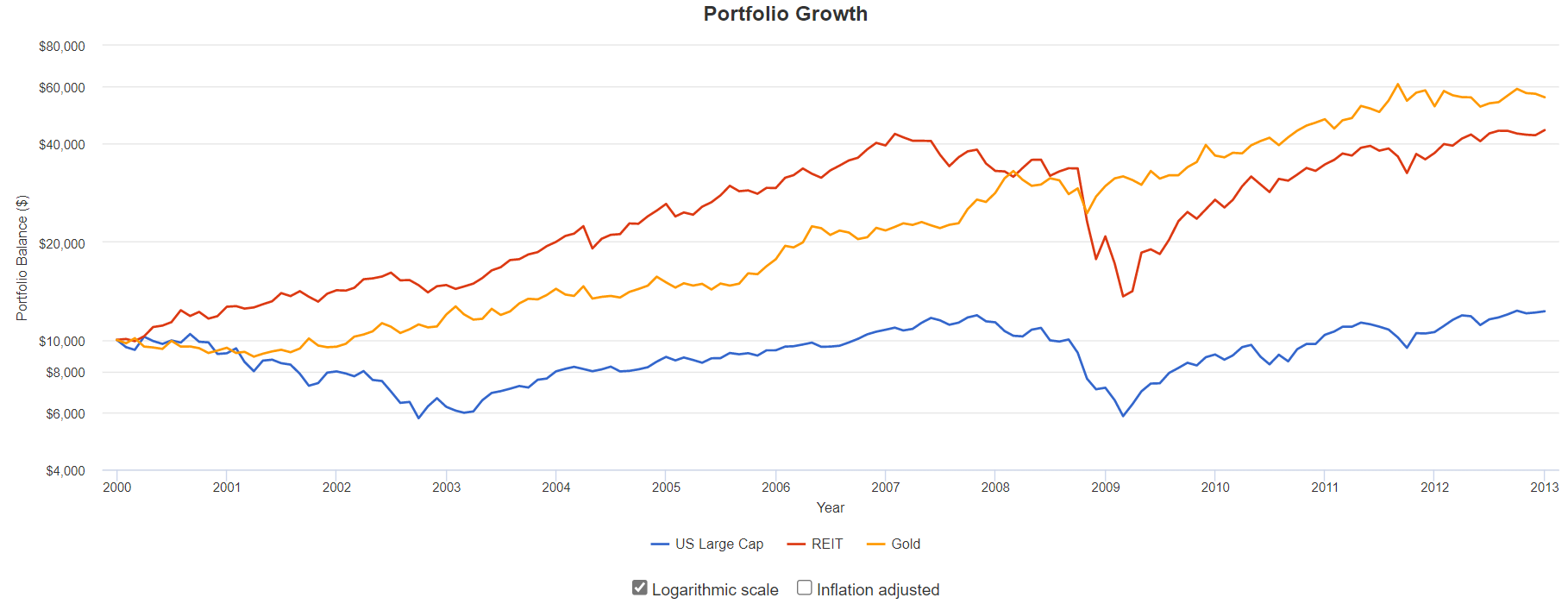

The next graphic shows what actually happened over the following 13 years. The blue line again is stocks, the red line is real estate and gold is the yellow line.

Stocks ended the thirteen years from 2000 through the end of 2012 with an average annual return of only 1.56%. There were many years (September 2000 to September 2006 and September 2008 to December 2010) during that time frame when the stock investments were below their January 2000 value. Over the same period, real estate was up 12% per year and gold was up 14% per year.

Owning just stocks turned out to be anything but a sure thing.

Perhaps we are at the start of another bad decade for stocks? In the past ten years, from 2012 to 2021, the relative performance of the three asset classes has been similar to the returns from 1994 through 1999.

Perhaps this drawdown in 2022 is going to turn out to be the start of a bad decade for stocks like the dot com crash of 2000 was. Things could happen in the future to the economy, world politics, the climate, and other areas which may limit stock increases over the coming years. I am not making a market prediction here, but my point is that past performance does not guarantee future results.

To overcome the unknowns of the future, we need to spread our investments over multiple asset classes or investment types.

When you invest new money or rebalance your investments today, you should be concerned about future performance and not assume that stocks will continue to outperform.

If you have questions or concerns about your portfolio allocation, please contact us today.