I recently spent four days at a tax training seminar for financial advisors. There were many impactful topics covered in the lessons. One of those, which I will cover in this blog post, is referred to as the widow’s (or widower’s) penalty.

When one spouse dies, the remaining spouse is allowed to file their taxes as married filing jointly (MFJ) one final time in the year of their wife’s or husband’s death. In the following years, unless they remarry, they must file their taxes as single.

This shift from married filing jointly to single can create a large tax increase, even though the widow’s / widower’s income goes down in a lot of cases. Let’s look at an example.

In this example, the couple were both retired and had various income streams. They had interest and dividends from their investments, required minimum distributions from their IRAs, a pension, and two Social Security benefits.

After the husband’s death, the widow’s Social Security income goes down because the survivor only gets the larger benefit, not both. In this example I held RMD and pension income constant for simplicity’s sake. In reality, the RMDs would change from year to year, but the pension income could stay the same if the pension had a 100% survivor benefit.

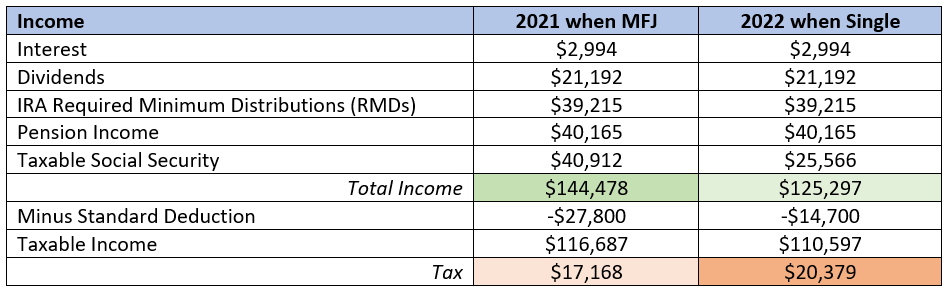

The following table shows the various incomes and the tax due.

You can see in this example that the widow’s income dropped $19,181 from $144,478 to $125,297. However, her taxes increased by $3,211 (from $17,168 to $20,379)! This is the widow’s penalty.

What can we do about this?

Planning for this scenario should be done many years in advance. If we look at the main sources of income, their pension income and Social Security income are out of our control. They will be what they will be. It is the IRA required minimum distributions (RMDs) that we could make an impact on, depending on the strategies we implement and their timing.

Large IRAs are a good thing to have, but they can create tax issues if they are not withdrawn from in a smart manner. It all depends on your particular circumstances and numbers, but perhaps using the IRA money to live on when you first retire, before RMDs begin would help to minimize these taxes. Or perhaps an aggressive Roth conversion strategy early in retirement would be the best option for you. There are no hard and fast rules, it all depends on how the numbers work out.

Medicare Impact

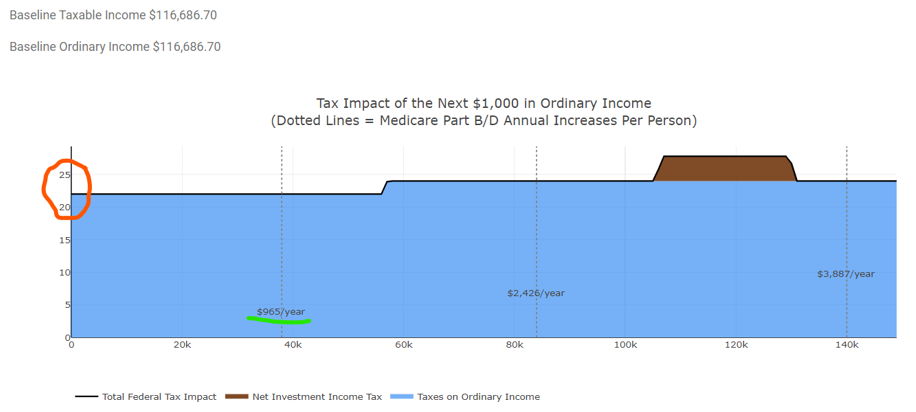

The next two diagrams bring up another important consequence of not optimizing your withdrawal strategy. These diagrams show the tax implications of each additional $1,000 of taxable income. In the top one, the married couple has about $38,000 of additional income they can handle before their Medicare premiums are bumped up due to passing an income limit. The increased Medicare expense is shown as the dashed, vertical lines.

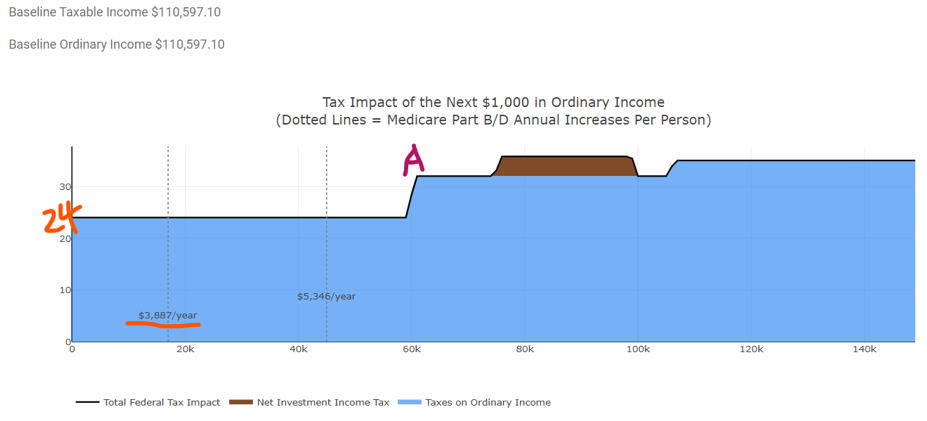

In the single widow’s graph, the second one, she only has about $17,000 of additional income available before her income pushes up her Medicare premiums.

The issue is not just that the widow will reach the Medicare expense threshold sooner, it’s that the increase will be far more significant than the couple who are both still alive. The widow would have to pay $3,887/year more for Medicare versus $965/year more for the couple.

If her IRA investment value stays about the same size or increases, her RMDs will be increasing each year, and she will likely hit this Medicare barrier, increasing her annual expenses by $3,887/year.

You can also see that in the second diagram showing the widow’s taxes, she could reach the 32% Federal tax bracket with $61,000 of additional income (point “A” on diagram). Whereas the 32% bracket does not show for the MFJ couple, even with an additional $150,000 of income.

Having a plan in place to manage the widow’s penalty tax issue, and other issues that are out there, could save you or your spouse a large amount of money. If you are interested in discussing your withdrawal plan, please use this link to set up an appointment.