I am writing today to make you aware of some things that are going on behind the scenes that are contributing to the current stock market sell off.

Last week I went to the Fixed Income and Dividend Investing Summit and then yesterday I received a market commentary (from Guggenheim Investments) describing the same scenario I heard about at the Investing Summit. It’s true that the market can be a bit of a rumor mill and very susceptible to groupthink, but whether the groupthink is correct or just rumors, if enough people believe it might be true, the markets will react.

Here is what I learned. The current worry for professional investors is the implications of rising interest rates. More specifically, the ability of corporations to make their loan payments to investors. In the past ten years when interest rates were very low, corporations took on a lot of debt by offering bonds. Even Apple, with its hundreds of billions of dollars in cash, offered bonds for the first time ever in 2012. From a Marketwatch article about Apple: “The bond debt load has now grown from zero to about $96.6 billion as of July 1, [2017].” Almost 100 billion owed in five years!

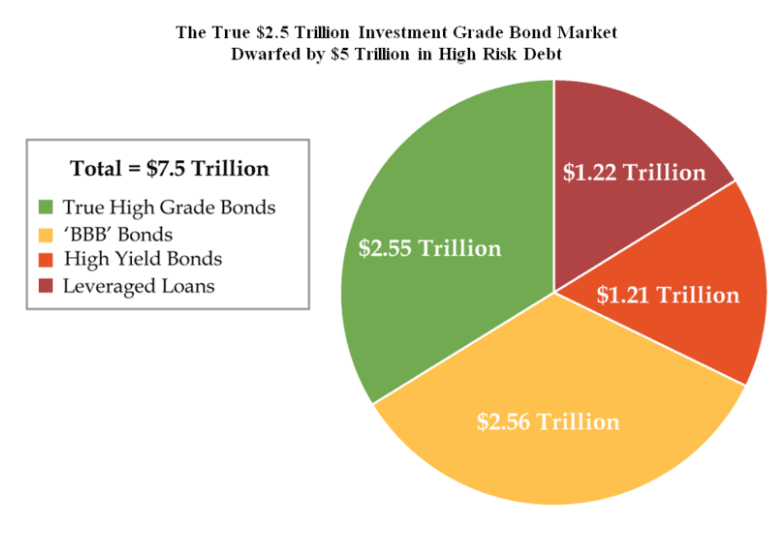

Now there are a lot of companies out there who have done similar things, but are not anywhere near as stable as Apple. In fact, there are trillions of dollars of bonds with the triple B rating rather than Apple’s AA+ rating.

Here’s why these ratings matter and why the investment universe has become nervous. If a corporate, investment grade bond fund owns a bond that is no longer investment grade, then the fund MUST sell it. Investment grade bond funds are only allowed to own investment grade bonds. All the popular bond funds (like the Vanguard Total Bond Market ETF (symbol BND) and the iShares Core US Aggregate Bond ETF (symbol AGG)) are investment grade funds. Basically everyone owns these types of funds in their 401(k).

If funds like these are forced to sell there could be huge problems. The size of the BBB market is $2.5 trillion dollars according to Bloomberg. But the size of the junk bond market is only $1.2 trillion dollars. It is impossible for the junk bond funds to be able to buy all the bonds that the investment grade funds could be forced to sell. There is only one outcome. Massive price declines! I haven’t seen any estimates on how much this scenario would affect the price of popular bond funds, but suffice it to say that it would be huge.

With these worries about bonds taking huge hits, and the high valuations from large stock market returns over the past ten years, decision makers have decided to pause their buying of stocks and reduce their risk. Hence the current stock market sell off.