In this post I am going to show you a method for calculating your pension value.

You can use these calculations to determine how much you would need in a retirement account (401(k)/403(b)/IRA) to safely withdraw an amount equal to your pension income.

The research behind the calculations comes from an article published in the Journal of Financial Planning, November 2018 issue. The article was titled “Annuitized Income and Optimal Equity Allocation”.

You can watch a video version of this post on Youtube by clicking here.

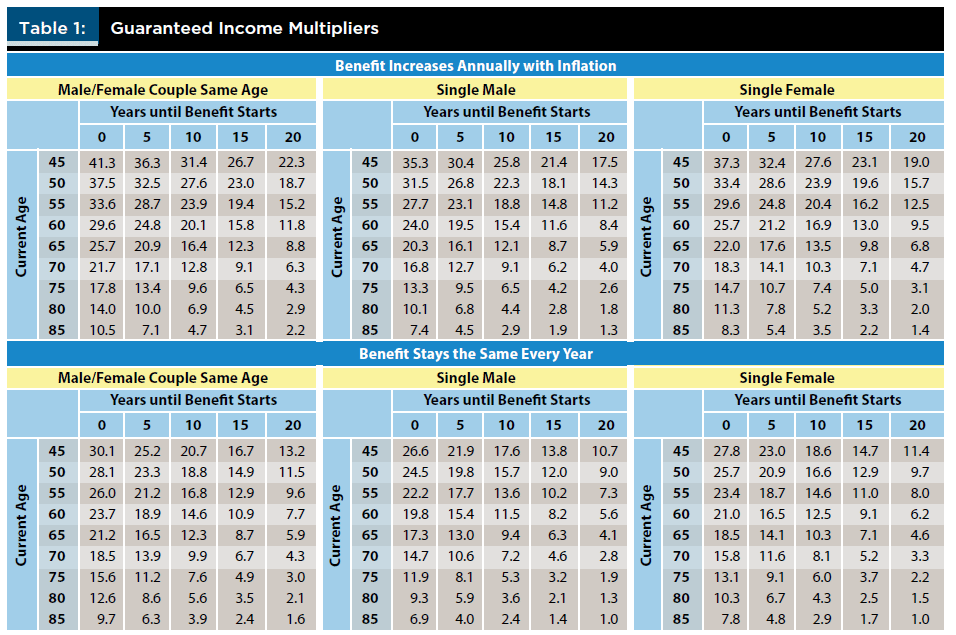

Here is the Income Multiplier chart from the research article:

In our first example, a pensioner receives $77,000/ year and that pension income increases with inflation. This pensioner is 70 years old, and his wife is of similar age.

Since his pension has a cost-of-living increase, we are using the top row of three results in the chart. His pension has already started so we will use column “0”. We find his multiplier is 21.7.

To calculate his pension’s value, we take his annual pension income and multiply it by 21.7.

$77,000 x 21.7 = $1,670,900 !!

So, for this couple to confidently withdraw an inflation adjusted $77,000 annually for the rest of their lives, they would need to have an additional investment account with $1.67 million in it!

Let’s look at two other examples and calculate how valuable their pensions are.

Next, we look at a firefighter captain who is retiring at age 55. His pension is $85,000. He is unmarried and so we will use the single male chart in the middle of the top row.

From the chart, we find his multiplier is 27.7.

Calculating the value of his pension means $85,000 times 27.7 for a total of $2,354,500 !!

This gentleman would have needed to have a high paying job to have accumulated $2.3 million by the age of 55! Instead, he risked his life and survived with a guaranteed income stream.

Not all pensions are large. Some will cover only a small portion of your expenses in retirement. For example, a lady had worked in the grocery industry when she was younger. She was entitled to a pension of $9,000 per year with no inflation increase, ends upon her death, and starts five years from now. She is currently 60 years old.

How much would an equivalent savings amount be?

From the chart above, we find her multiplier. It is 14.1.

$9,000 x 14.1 = $126,900!

From these examples, you can see that a pension is an extremely valuable asset.

It would take many years of saving and successful investing to accumulate an equivalent amount.

Contact Andrew Marshall Financial, LLC today to talk about your pension, retirement, or other financial planning needs.