Will your Social Security payments cover your retirement lifestyle? Do you plan to rely on Social Security for most of your retirement income?

Most people have no idea how their future social security payments compare with their current income. If you are thinking you can retire in five years or less, make sure you log on to ssa.gov and look at your Statement. Your Statement will give you an estimated monthly benefit payment that you have accumulated. This is what you would get if you retired tomorrow. Is it as much as you were expecting?

I doubt it. I find people vastly underestimate the amount of money they will get from Social Security. This can have a dramatic effect if you are approaching retirement and expecting a larger amount than you are due. If you are counting on Social Security to provide a large portion of your retirement income, think again.

Social Security was designed as a safety net to provide the poorest Americans with food and shelter in their old age. Social Security is not an income replacement program or a retirement plan for the masses. It is an anti-poverty program. Those who have middle to high incomes will not receive anywhere near their current income from Social Security.

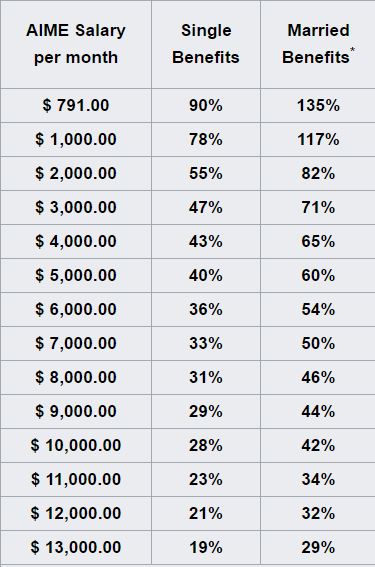

The chart at left shows the average indexed monthly salary (AIME) and the corresponding percentage of that salary that will be received from social security. The average indexed monthly salary takes your highest 35 years of salary and indexes each year for inflation so that your early years of work are given the same weight as recent years. That doesn’t mean you can look at the chart and see what you are making now and look to see the percentage.

The chart at left shows the average indexed monthly salary (AIME) and the corresponding percentage of that salary that will be received from social security. The average indexed monthly salary takes your highest 35 years of salary and indexes each year for inflation so that your early years of work are given the same weight as recent years. That doesn’t mean you can look at the chart and see what you are making now and look to see the percentage.

Most people’s salary has progressed over their career, but some people have low or non-earning years if they left the workforce to raise kids for example. These lower year’s decrease your average. In order to get an estimate on what your average is, you have to go online to My Social Security.

Let’s look more closely at the chart numbers again and examine two scenarios. Someone who has had a good paying job and has an AIME of $8,000 per month (about $100,000) per year will have a payment of 31%. That’s 31% of 8,000 per month. Or $2,480. If this person is relying on Social Security to cover their retirement expenses, they are in for a challenge. It is really hard to change your lifestyle from living on $8,000 per month to $2,480!

I mentioned earlier that Social Security is really a program to keep people out of poverty. The poverty level for a single person is $11,880 per year. Let’s call it $1,000 per month. Someone earning $1,000 per month would receive $780 per month from Social Security. Now it would be hard to live on that amount, but it would not be as big of a change from $1,000 to $780 per month as the change would be from $8,000 to $2,480.

This issue of Social Security payments being smaller than expected is one of many reasons it is a good idea to talk to a fee only financial planner as early as possible. By monitoring your financial situation and working with a fee-only financial planner for many years leading up to retirement, low Social Security payments won’t come as a shock.

To retire comfortably, you need other sources of income. It is important to work somewhere that provides a pension, 401(k) or other retirement savings, so you are forced to contribute before it is too late. If there are no other retirement savings, then there may be no choice for retirement other than working longer and experiencing a major lifestyle change. Neither of which are much fun.