Health Savings Accounts (HSA) are a smart way to establish an extra source of funds you can tap into to cover medical expenses later in life. You can use the funds immediately, but the true benefit comes after giving the account a chance to grow. HSAs are accounts, held by a custodian such as a bank, whose withdrawals (including the gains from investing the savings) are tax free if used for health care expenses. By taking advantage of these accounts, the government hopes citizens will be better able to cover the future costs of health care. We all know medical costs are increasing quickly, and we have heard the stories about people who are forced to spend down all or most of their retirement savings to cover their health care costs. A health savings account should provide you with an extra layer of protection in the future.

First question is, who is eligible for an HSA? 1. You cannot be claimed as a dependent on someone else’s tax return. If they could claim you but don’t, then you are not eligible. 2. You cannot be on Medicare. 3. You must be covered by a High Deductible Health Plan (HDHP) and no other plan on the first day of the month. (There are of course exceptions, but these are mostly for additional plans that do not pay before the HDHP deductible is reached.)

Second question is how much can someone contribute to their HSA in 2016? The contribution limits for 2016 are $3,350 for someone with self-only HDHP coverage and for a family with HDHP coverage the max is $6,750. These amounts are the maximum for someone with qualifying health insurance and HSA eligibility each and every month of the year. Some people aren’t eligible every month of the year, and they need to do a calculation to determine how much their maximum is. Contributing more than your maximum allowed and not correcting the mistake will lead to a 6% excise penalty.

Additional Contribution: Those eligible individuals who are 55 years of age and older at the end of their tax year are allowed to contribute an extra $1,000.

The last-month rule is a shortcut determination used to determine if you are eligible to contribute the maximum amount. The last-month rule states that a person who is eligible to contribute to an HSA on the first day of the last month of their tax year is treated as being eligible the entire year. The day used for determination is December 1 for most people. So if you meet the requirements on December 1, you can contribute $3,350 for a single person or $6,750 for a family.

The last-month rule is a shortcut determination used to determine if you are eligible to contribute the maximum amount. The last-month rule states that a person who is eligible to contribute to an HSA on the first day of the last month of their tax year is treated as being eligible the entire year. The day used for determination is December 1 for most people. So if you meet the requirements on December 1, you can contribute $3,350 for a single person or $6,750 for a family.

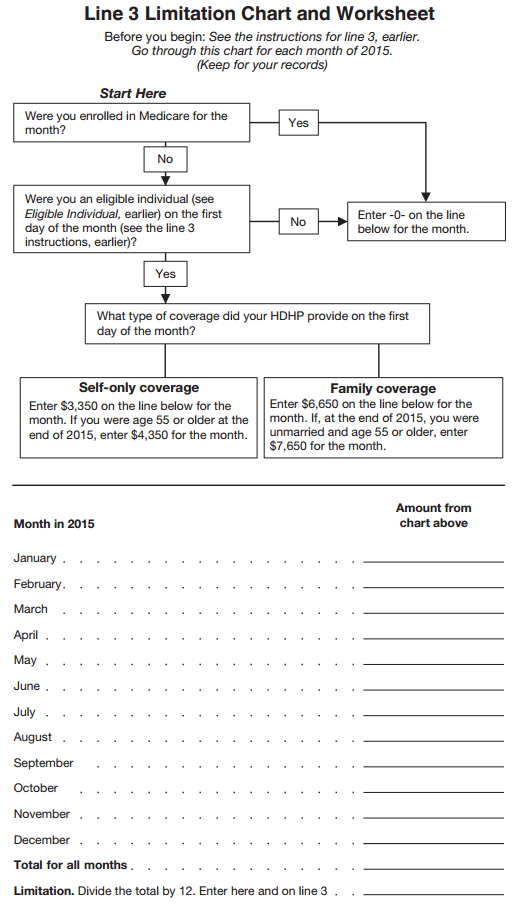

What if I wasn’t covered in the last-month? You must use the “Line 3 Limitation Chart and Worksheet” found in the instructions pdf for IRS Form 8889.

Putting money away in a Health Savings Account is a good idea if you are eligible for one. Many employers are now offering it as an alternative to HMO medical coverage. Be sure to calculate your maximum allowed to avoid paying penalties.