If you receive a pension, what stock allocation percentage should you use in your investment accounts?

Every retiree or soon to be retiree needs to determine how much of their investments to place in stocks.

The standard answer for retirees is that a 50% – 60% stock allocation maximizes portfolio longevity. If a retiree receives a pension or other guaranteed income like an annuity, then 50% – 60% may not be the best answer.

Guaranteed or annuitized income increases the safety of your retirement. Someone without guaranteed income must fund 100% of their retirement spending needs solely from investments. To remain solvent throughout their lifetime, they must err on the conservative side (own a higher percentage of bonds and cash) to provide a buffer during years the market is down.

On the other hand, if you have enough guaranteed income to cover at least your basic lifestyle needs, then you can let your stock investments fluctuate without it impacting your retirement safety.

Current Research

Let’s look at what the current research has to say about the optimal stock allocation when one has various portions of their income guaranteed. The research behind the calculations comes from an article published in the Journal of Financial Planning, November 2018 issue. The article was titled “Annuitized Income and Optimal Equity Allocation” by David M. Blanchett, Ph.D., CFA, CFP® and Michael Finke, Ph.D. CFP®.

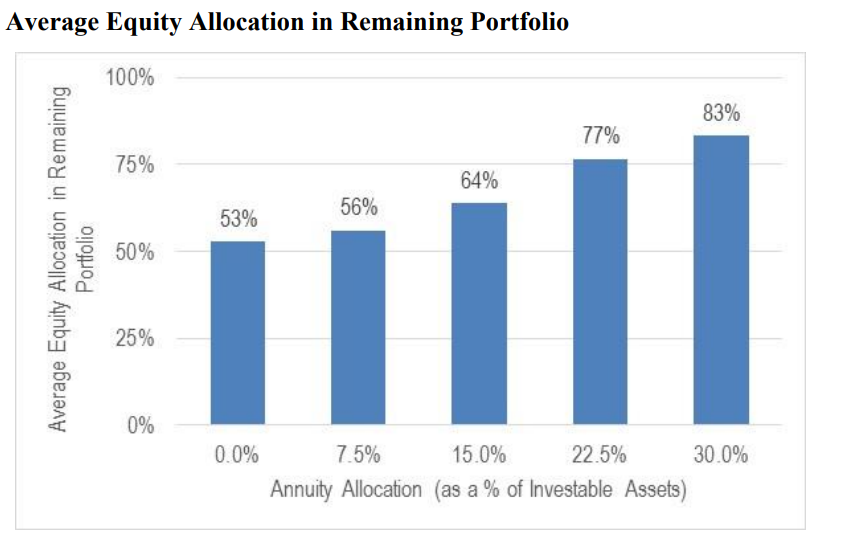

The results are based on a couple both age 65 who will live slightly longer than the Social Security mortality rates predict, and their guaranteed income increases each year with inflation. The following chart shows the results combined into graph form to show the average allocation to stocks when compared to percentage in annuitized income.

The trend is clear. The more guaranteed income a retiree has, the higher the optimal allocation to stocks. This is due to the safety the guaranteed income provides.

Pensioners and annuitants can handle more market volatility than other retirees.

Example

Let’s look at an example for a retired couple who have $600k of investments and would like an income of $95,000 per year, before taxes. The gentleman receives a $77,000 pension annually. To make up the difference, they must withdraw $18,000 per year from their investment accounts. That is a 3% withdrawal rate ($18k/$600k).

First, we need to calculate the value of his guaranteed income. These calculations are explained in this post: What is a Pension Worth?. His pension is worth $1,670,900. Therefore, the percentage of this couple’s wealth that is in annuitized income is therefore 74%:

$1,670,900/$2,270,900 = 74%

(The $2.27 million figure comes from adding his pension value to their investment value: 1,670,900 + 600,000 = 2,270,900)

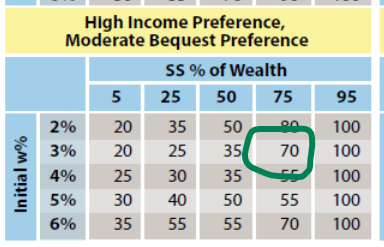

Using the chart provided in the research article, they should be invested at an allocation of 70% stocks to maximize their lifetime income and legacy to their children or charities.

If you have questions about your own investment allocation or how your pension, investments, Social Security and other aspects of your finances will come together in retirement, please click here to schedule a free meeting.